Market Verdict on Iron Ore:

• Neutral.

Macro:

• China 1-year length and 5-year length Loan Prime Rate down 10 bps, previously maintained unchanged for 9 months.

• China NBS: China produced 16,613 units of excavators, down 25.9% on the year. Total produced 117,524 units of excavators, down 17.8% on the year.

Iron Ore Key Indicators:

• Platts62 $115.50, +0.10, MTD $112.36. Although PBF witnessed a fast growth during the past two weeks, BHP sold JMBF based on July Index average and a discount of $5.3, last week discount was $4.2. Considering the cost-efficiency, mid-grades are still the best options for mills. However some traders indicated that the high grade and low grade blending are growing on the cost efficiency as well.

• In last week, Australia and Brazil total delivered 28.62 million tons of iron ore, up 2.61 million tons. Australia delivery to China at 17.95 million tons, up 3.068 million tons.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 19th)

• Futures 101,051,200 tons(Increase 2,215,300 tons)

• Options 112,459,600 tons(Increase 3,878,000 tons)

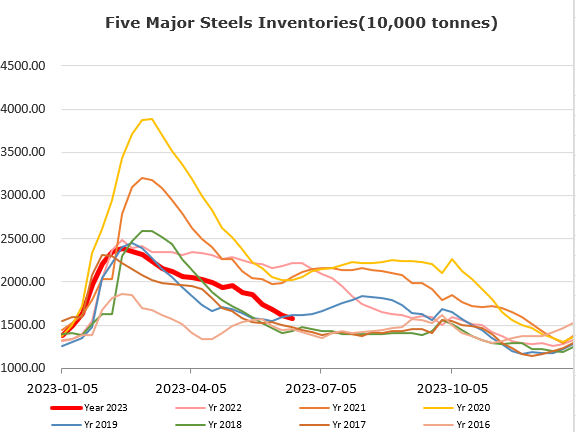

Steel Key Indicators:

• Arcelor Mittal increased HRC at Alabama by $50/st to $950/st.

Coal Indicators:

• Major Cokery plant proposed price increase to steel mills by 100 yuan/ton, after 10 rounds of cut during past three months.