Verdict:

• Short-run Neutral.

Macro:

• During the Finance Forum in Lujiazui, Shanghai, PBOC’s Pan signals supportive monetary in China, however with limits. The chairman of Regulatory body CSRC mentioned strategic role of high quality development among listed companies, improving companies value and protecting investors rights.

Iron Ore Key Indicators:

• Platts62 $107.35, +1.20, MTD $107.20. As we expected, the correction of Asian afternoon on futures market finally attracted bottom hunting physical buyers during MOC. The index support around $100 -105/mt was proven strong. There three mid-grade laycans traded with fixed price yesterday.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 19th)

• Futures 124,445,900 tons(Increase 2,035,000 tons)

• Options 170,076,600 tons(Increase 2,739,000 tons)

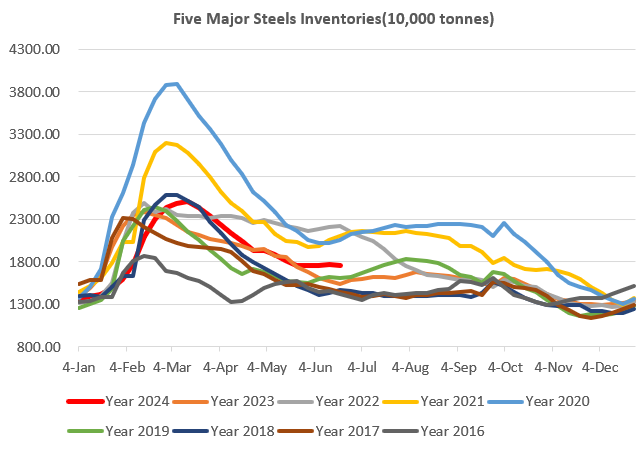

Steel Key Indicators:

• China Tangshan average billet cost at 3354 yuan/ton, down 71 yuan/ton on the week, average profit at 26 yuan/ton, up by 81 yuan on the week.

Coal Indicators:

• MySteel indicated that the biggest Mongolia coal port Ganqimaodu, exported 18.05 million tons of coals to China, up 25.08% on the year.