Market Verdict on Iron Ore:

• Neutral.

Macro:

• Bloomberg: China mulls mortgage easing to spur home purchases in Tier I cities including Beijing and Shanghai.

Iron Ore Key Indicators:

• Platts62 $114.00, -1.85, MTD $111.53. The seaborne iron ore suddenly muted yesterday after a big day before, indicating that the market yet to agree with a growth trend in mid-run. However the overall big volume in July compared with late June or last year indicated a resilient demand market.

• Rio Tinto believed that the total delivery in 2023 would reach the upper range between 320 -325 million tons of shipment guidance.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 19th)

• Futures 101,811,600 tons(Decrease 488,900 tons)

• Options 101,778,300 tons(Decrease 1,222,500 tons)

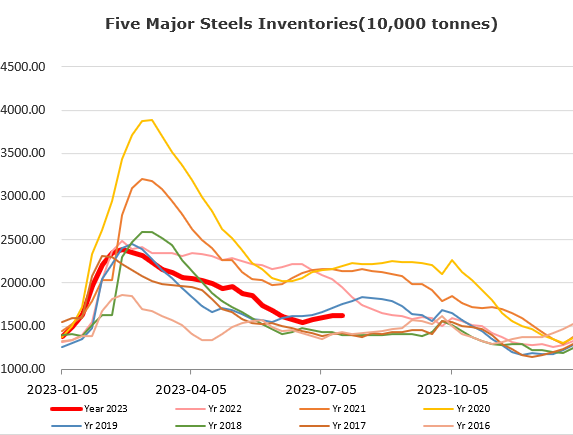

Steel Key Indicators:

• MySteel estimated July pig iron production at 74.46 million tons, up 1.256 million tons from June, up 5.736 million tons on the year.

Coal Indicators:

• The safety check on some miners stimulated a tight supply sentiments in Chinese prime coal market. Thus, DCE coking coal spiked in the last few trading days.