Market Verdict on Iron Ore:

• Neutral.

Macro

• China central bank decreased the one year Loan Prime Rate from 3.8% to 3.7%, the second month decrease. Five Year Loan Prime Rate decreased from 4.65% to 4.6%, previously this rate was fixed for 2o consecutive months.

• U.K. December 2021 CPI up 5.4%, created the highest level since March 1992. The growing inflation rate raised expectation on interest rate increase.

Iron Ore Key Indicators:

• Platts62 $130.20, +2.90, MTD $126.55. Iron ore seaborne trade actively in the first half of the week based on the monetary loose support on Monday and Tuesday from China. However PBF have massive offers with very limited bids interested. Physical traders don’t want to hold any inventory across Chinese New Year and Beijing Winter Olympic Games.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 19th)

• Futures 87,011,700 tonnes(Increase 875,100 tonnes)

• Options 46,713,800 tonnes(Increase 1,022,000 tonnes)

Steel Key Indicators

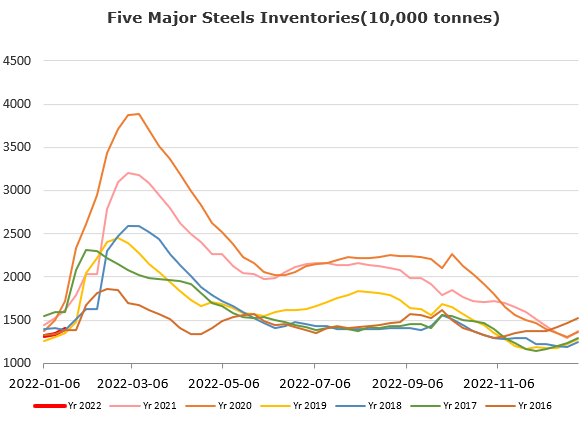

• MySteel Rebar Inventory: Rebar production 2.64 million tonnes, down 7.31% w-o-w. Mills inventory 1.79 million tonnes, down 0.88% w-o-w. Circulation inventory 4.17 million tonnes, up 12.69% w-o-w.

• Tangshan average billet cost 4207 yuan/tonne, up 68 yuan/tonne w-o-w. Average steel margin 203 yuan/tonne, down 28 yuan/tonne.

• Asean six countries steel apparent consumption up 8.6% y-o-y at 77.2 million tonnes.

• Mysteel estimated Tangshan area crude steel production 10 million tonnes, down 2.43 million tonnes from the year 2021. In addition Tangshan area would maintain daily utilisation rate at 55%, down 13% from January.

Coal Indicators

• Ganqimaodu port recopened today. Mandula port cleared 60 coal trucks yesterday, returned to normal level.