Market Verdict on Iron Ore:

• Neutral.

Macro

• After experienced the super central bank week, BOE started the first round of interest rate raise. ECB increased asset purchase plan. Russia announced the seventh interest rate increase of the year. Other new emerging market countries also announced interest rate raise. However major economies in Asia remain unchanged interest rate.

• China National Bureau of Statistic indicated China Jan – Nov produced 329,044 units of exavators, up 10.5% y-o-y. However November production down 15.6% y-o-y at 29,850 units, down 4.2% m-o-m.

• U.S. federal governor Waller indicated that Federal expected to increase interest rate in next March or May. The last one or two interest rate increase potentially include a shrinking on balance sheet.

Iron Ore Key Indicators:

• Platts62 $118.25, +3.55, MTD $106.51. Seaborne iron ore were strong during the current two trading days, however onshore iron ore at ports were weak. DCE iron ore and port iron ore revealed an expectation of continuous improved port inventories provided variety of deliverable resources, which alternatively lower the benchmark price on DCE value. Seaborne iron ore currently revealed a real demand market after China completed the growth plan of the year 2021, which left more room of steel production in the following few months.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 17th)

• Futures 89,678,600 tonnes(Increase 1,256,600 tonnes)

• Options 61,418,000 tonnes(Increase 1,343,000 tonnes)

Steel Key Indicators

• China sample EAF enterprises December expected utilisation rate 53.4%, expected January utilisation rate 41.19%, down 22.78% y-o-y.

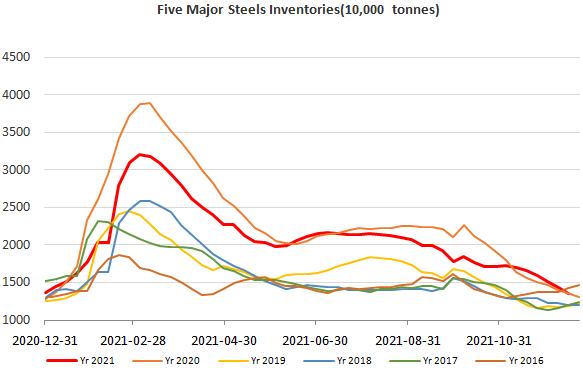

• Steel bank: Construction steel inventories 3.34 million tonnes w-o-w, down 7.88%. HRC inventories 1.74 million tonnes, down 6.08% w-o-w.

Coal Indicators

• China Coal Resources News indicated that Shanxi province in China closed many under qualified coking capacities accounted 5.84 million tonnes of coal, however new built capacities have some time lag to fill the gap. As a result, coal supply remain tight expected through December and next January in western China.