Verdict:

• Short-run Neutral.

Macro:

• The Eurozone November CPI reached – 0.6% on the month, refreshed the biggest monthly drop since January 2020.

• The situation in the Red Sea lift concerns from traders, WTI continued its upward trend and once rose by more than 2%. The world’s biggest shipping companies said container freight rates may increase significantly.

Iron Ore Key Indicators:

• Platts62 $133.80, -0.15, MTD $134.78. BHP sold MACF at fixed price at $132.1/mt, expected to arrive before Chinese New Year. Many seaborne needs to think about the arrival windows in February. The PBF saw some inquiries because of higher stocks on portside compared to other brands. The heavy snow slowed down the logistics and operations in northern China ports.

• China total produced 904.03 million tons of iron ore from January to November, up 7.1% on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 19th)

• Futures 121,515,600 tons(Increase 738,200 tons)

• Options 105,743,700 tons(Increase 1,040,000 tons)

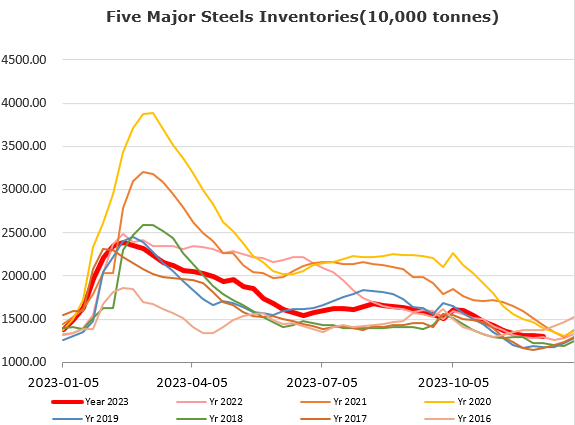

Steel Key Indicators:

• China National Bureau of Statistics: Crude steel output in November 2023 was 76.099 million tons, a year-on-year increase of 0.4%; from January to November, China’s crude steel output was 952.140 million tons, a year-on-year increase of 1.5%.

Coal Indicators:

• Polish coking coal producer JSW said the fire accident happened earlier this month would reduce 350,000mt output in 2024.