Verdict:

• Short-run Neutral.

Macro:

• The Ministry of Housing and Urban Rural Development held a conference on acquisition of existing commercial houses for use as affordable houses. Many regions should promote cities at or above the county level to effectively and orderly carry out the purchase of existing commercial housing as affordable housing.

Iron Ore Key Indicators:

• Platts62 $106.70, -0.65, MTD $107.16. As we expected in most time of the week, iron ore saw bottom hunting after futures corrected in Asian afternoon session. There were two laycans of lumps on index linked and two mid-grades traded in fixed price.

• China 45 ports iron ore inve:ntories at 148.83 million tons, down 93,500 tons on the week, up 20.90 million tons on the year. Daily evacuation 3.1152 million tons, up 21,400 tons on the week, up 77,000 tons on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 20th)

• Futures 125,208,600 tons(Increase 762,700 tons)

• Options 171,091,600 tons(Increase 1,015,000 tons)

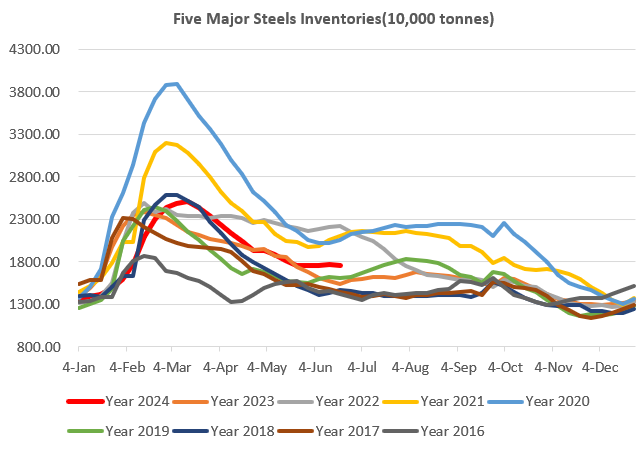

Steel Key Indicators:

• China blast operation rate at 82.81%, up 0.76% on the week, down 1.28% on the year. China daily pig iron production at 2.3994 million tons, up 6,300 tons on the week, down 59,200 tons on the year.

Coal Indicators:

• The market liquidity was thin during the entire week, with some July demand reply on index-lined basis. However some traders maintained bullish because the incoming India Moonson season and tight supply.