Verdict:

• Short-run Neutral.

Macro:

• Beijing planned to allow local governments to sell 1.5 trillion yuan of special bounds to repay debts. Banks cut key lending rates by 15 bps this week.

Iron Ore Key Indicators:

• Platts62 $109.35, +0.55, MTD $105.60. The traders were concerning about the fast uptick on low grade fines inventories at Chinese northern ports. However the August maintenance expected to decrease in China compared to July. The high operation rate became a strong support for iron ore demand. JMBF was sold by BHP at September index + $3.6/mt MACF was sold at fixed price at $106.15.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 18th)

• Futures 117,308,600 tons(Increase 1,637,600 tons)

• Options 106,147,400 tons(Increase 2,323,000 tons)

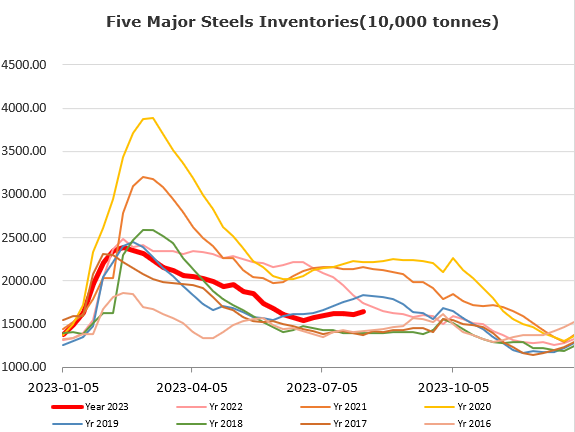

Steel Key Indicators:

• The imported iron ore inventories at Chinese steel mills reached 83.66 million tons, down 233,900 tons on the week.

• MySteel sample 87 EAFs average operation rate at 74.64%, up 0.52% on the week, up 19.1% on the year.

Coal Indicators:

• The first round of Chinese domestic coke price cut at 100- 110 yuan/ton were proposed by steel mills last Friday.