Market Verdict on Iron Ore:

• Neutral to bearish.

Macro

• US Treasury Secretary Yellen said that inflation is expected to remain above 2% in 2022. There are many uncertainties about inflation. Over time, the inflation rate is expected to decline this year.

• U. S. initial jobless claims increased from 231,000 to 286,000 last week, estimated 220,000, created the highest number since the mid-October in the year 2021.

Iron Ore Key Indicators:

• Platts 62%: $133.65 (+3.45) MTD $127.06. Iron ore seaborne trade actively in the first half of the week based on the monetary loose support on Monday and Tuesday from China. However PBF have massive offers with very limited bids interested. Physical traders don’t want to hold any inventory across Chinese New Year and Beijing Winter Olympic Games.

• MySteel 45 ports iron ore inventories at 154.36 million tonnes, down 2.61 million tonnes w-o-w. Daily evacuation 3.28 million tonnes, up 159,500 tonnes w-o-w. Australia iron ore 72.21 million tonnes, down 1.63 million tonnes w-o-w. Brazil iron ore 54.51 million tonnes, down 766,620 tonnes w-o-w. 178 ships at ports, up 11.

SGX Iron Ore 62% Futures& Options Open Interest (Jan 20th)

• Futures 87,588,500 tonnes(Increase576,800 tonnes)

• Options 48,113,800 tonnes(Increase 1,400,000 tonnes)

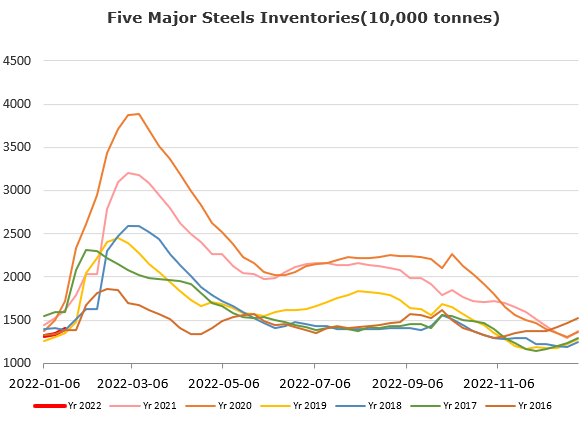

Steel Key Indicators

• Tangshan average billet cost 4207 yuan/tonne, up 68 yuan/tonne w-o-w. Average steel margin 203 yuan/tonne, down 28 yuan/tonne.

• Mysteel researched 247 blast furnace operation rate at 76.25%, up 0.48% w-o-w. Utilisation rate 81.08%, up 1.19% w-o-w. Daily pig iron production 2.18 million tonnes, down 253,500 tonnes.

Coal Indicators

• Ganqimaodu port recopened yesterday. Indonesia recovered export coking coals. Physical coke market in China started to decline observed by coke plants offers in north-western areas.