Market Verdict on Iron Ore:

· Neutral.

Macro

· China PM Li Keqiang held conference to punish illegal speculation on coal market and prevent the price transmission from commodities to downstream, and avoid cost increasing on mid-small capital company.

· China Zhejiang Province downgrade the electricity consumption level from C to B, indicating the power supply was becoming sufficient.

· Indonesia president Joko Widodo indicated that Indonesia planned to stop export commodities to increase local processing businesses on resources and new businesses booming. The prohibition export list included nickel, tin, copper and unprocessed minerals related to batteries materials and aluminum industries.

Iron Ore Key Indicators:

· Platts62 $124.45, +0.95, MTD $123.28.

· Vale planned to decrease the low grade iron ore supply on Q4 because of the significant decrease on iron ore prices. The decrease on supply estimated at 4 million tonnes.

· Russia iron ore miner NLMK Q3 iron ore production 5.1 million tonnes, up 1% compared to Q2, up 24% y-o-y.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 20th)

· Futures 72,276,200 tonnes(Increase 862,200 tonnes)

· Options 85,079,000 tonnes(Increase 45,000 tonnes)

Steel Key Indicators

· Tangshan sample steel mills average pig iron pre-tax cost 3886 yuan/tonne, billet cost 4873 yuan/tonne. Steel average profit 297 yuan/tonne, down 125 yuan/tonne w-o-w.

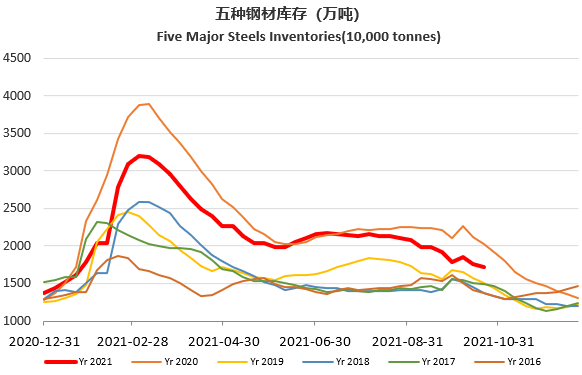

· MySteel Rebar Inventory: Rebar production 2.73 million tonnes, down 1.37% w-o-w. Mills inventory 2.44 million tonnes, up 3.2% w-o-w. Circulation inventory 5.89 million tonnes, down 4.25% w-o-w.

Coal Indicators

· China NDRC: China power plants coal supply reached 1.1 million tonnes, inventories increased 10 million tonnes compared to late September. Useable days reached 16 days. Estimate the inventories and useable days to reach last year level by late October.