Market Verdict on Iron Ore:

• Neutral.

Macro:

• CSRC allowed real estate company to finance in A share if meet with required conditions.

• China Securities Finance lowered the overall refinancing rate by 40bps to meet with the low cost financing of security companies

• New projects started concentrated in mid-China with total 480.3 billion yuan investment, covering infrastructure and manufacturing area.

• U.S. 2-year bond yield refreshed 15-year high at 4.55%, the high of swap market once approached 5%.

Iron Ore Key Indicators:

• Platts62 $91.40, -2.35, MTD $95.32. The trade activities on seaborne market return to stable mode with positive mid-grade trades, including MACF, PBF and NMHG seeing this week. However BRBF and IOCJ would potentially correct compared to other discount ores or mid-grade because of the extreme low margin in Chinese mills. Lump market was quiet because the speculation following meeting and production curb called an end in October.

• MySteel 45 ports iron ore inventories at 129.13 million tons, down 799,400 tons w-o-w. Daily evacuation 2.9872 million tons, down 153,500 tons w-o-w. Australia iron ore 57.68 million tons, down 463,700 tons w-o-w. Brazil iron ore 46.30 million tons, down 112,300 tons w-o-w. 63 ships at ports, down 28.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 20th)

• Futures 98,666,800 tons(Increase 1,160,600 tons)

• Options 86,651,900 tons(Increase 1,754,500 tons)

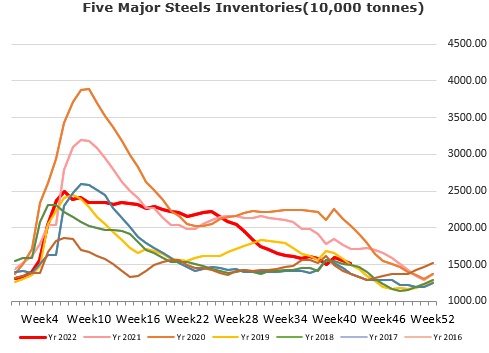

Steel Key Indicators:

• Tangshan average pig iron cost 2942 yuan, billet cost 3818 yuan/ton, down 30 yuan on the week. Average loss at 198 yuan/ton on steel production, increased 20 yuan/ton from last week.

Coal Indicators:

• FOB Australia coking coal rebounded significantly by $5 to $299, concerning the supply tension after BOM reported a heavy rainfall of 100mm in Gladstone Port. The indicative tradeable value of Goonyella and Peak Downs was ranged from $296 – 307. A 75,000mt HCCA Branded offered at $350, for early January laycan.

• Australia total exported 262 million tons of coals, down 13 million tons(or 4.7%) on the year. Thermal coal exported 141 million tons, down 5.4% on the year. Coking coal exported 121 million tons, down 3.9% on the year.