Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. Atlantic Federal president Raphael Bostic indicated that he decided to “give up” 75 interest hike in December FOMC, and believed that target policy interest rate of the Federal Reserve only needs to be raised by no more than 100 bps to fight inflation.

• U.S. houses sales decreased for nine month consecutively, however house price up 128 months consecutively. The 30-year mortgage rate reached 20-year-high.

Iron Ore Key Indicators:

• Platts62 $99.10. +0.75, MTD $90.61. The seaborne market saw less bids although macro environment recovered during last two weeks. PBF and NHGF were fixed in the late half of last week. India announced to cut export duties from 45-50% to 30% on the iron ore and pellets with ferrous grade below 58%. Previously, Chinese iron ore import from India down 70% during the first nine months because of tariff increase in May. MySteel estimated the India export would recover to 4.5- 5 million tons per month from December or next January.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 18th)

• Futures 117,700,400 tons(Increase 5,384,100 tons)

• Options 90,375,900 tons(Increase 3,237,000 tons)

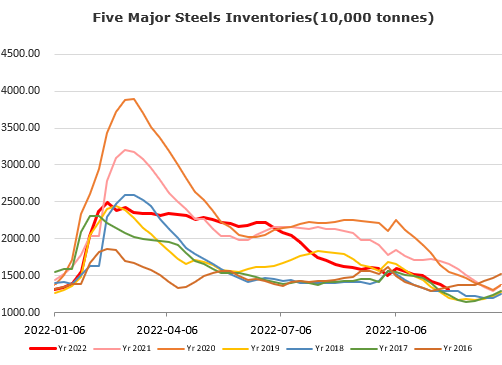

Steel Key Indicators:

• China Zenith ex-factory rebar up 50 yuan/ton in late November at 3950 yuan/ton.

Coal Indicators:

• Chinese physical coke decreased three rounds total 300 -330 yuan/ton. Coke plants utilisation rate was in low area. Market participants believed it was difficult to see further cut on coke output.