Market Verdict on Iron Ore:

· Iron ore short-run bearish.

Macro

· U.S. 10 year treasury bonds yield corrected to 1.425%, which was a new low from March, 2021.

· On June 18th, China PM Li Keqiang held a conference to conduct a decrease on mid-small capital enterprises fees and tax, to decrease the upstream pressure from commodity prices.

· St. Louis Fed chairman Bullard expected inflation to reach 2.5% to 3% by the year 2022, meeting the framework target, and prepare to raise interest rates. The matrix shows that interest rates will pick up at the end of 2022.

Iron Ore Key Indicators:

· Platts62 $217.30, -3.50, MTD $214.16. Iron ore corrected after the Friday news that China National Department and Reform Commission and several departments jointly investigate and research to ensure the price stability.

· Virtual steel margin retreated 60% from mid-Nay 1450- 1500 yuan/tonne.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 18th)

· Futures 84,479,000 tonnes(Increase 172,800 tonnes)

· Options 83,742,300 tonnes(Increase 957,500 tonnes)

Steel Key Indicators

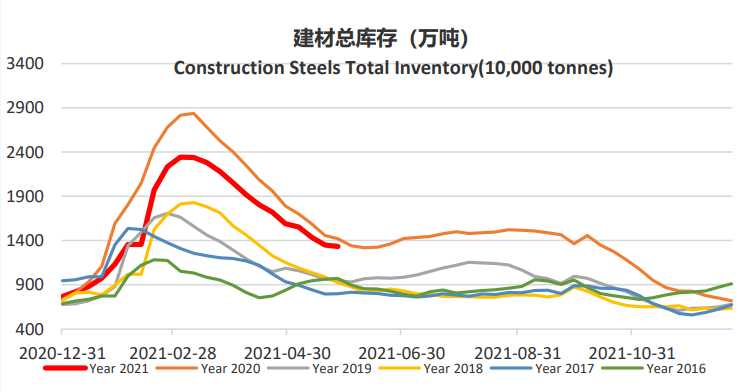

· Many areas of China were impacted by high temperature and heavy rains. China cement market continuous to weaken. Many provinces down 50 yuan/tonne, created the biggest monthly drop since February.

· China 18 independent EAF average construction steel cost 4914 yuan/tonne, up 94 yuan/tonne. Some areas in Guangdong Province were operated on the edge of marginal loss.

· HBIS planned to start a maintenance on 3200m³ blast furnace, last 40- 50 days, expected to impact 8,500 tonnes of pig iron per day. From June 21st, AnSteel maintainance expected to impact 3,000 – 4,000 tonnes of rebar production for three days.