Market Verdict on Iron Ore:

· Iron ore short-run neutral to bearish.

Macro

· The Asian Development Bank predicts that China’s economic growth is expected to remain at 8.1% this year and 5.5% in 2022. However, the overall growth expectations of Asian developing economies have been lowered.

· The National Development and Reform Commission held a conference analyzed the current commodity price, and required local commodity price authorities to focus on strengthening price monitoring, early warning and expectation management, strengthening the regulation of commodity prices, ensuring the supply and price stability of important livelihood commodities, and reaching the overall price level regulation target this year.

Iron Ore Key Indicators:

· ESteel(Jul 12-18th), Four big miners total shipped 19.03 million tonnes of iron ore, up 964,000 tonnes w-o-w. Total delivered 15.3 million tonnes to China, up 1.3 million tonnes w-o-w. The delivery to China accounted 80.41% out of total delivery.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 20th)

· Futures 84,768,900 tonnes(Increase 439,700 tonnes)

· Options 82,792,900 tonnes(Increase 250,000 tonnes)

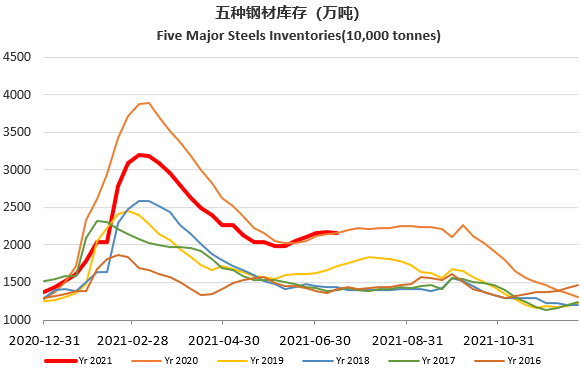

Steel Key Indicators

· Zenith Steel late July ex-work rebar up 100 yuan/ton, HRB400 16-25mm width traded at 5400 yuan/ton.

· Ganggu Construction Steel Inventory: production 5.26 million tonnes, down 50,200 tonnes w-o-w. Mills inventory 4.81 million tonnes, up 350,300 tonnes w-o-w. Circulation inventory 5.598 million tonnes, up 23,200 tonnes w-o-w.

· The preliminary maintenance plan of east China steel mills will be implemented by the end of July. This overhaul involves from steelmaking to steel rolling. With the local electricity power limited notice, it is estimated that the output of No. 300 stainless steel will be reduced by a quarter of that month.