Market Verdict on Iron Ore:

• Neutral.

Macro:

• IMF indicated that Asian central banks would think about incease interest rate if inflation failed to reach the target rate in 2023.

• U.S. Manufacturing PMI reached 47.8 in February, up from 46.9 in January, refreshed a four-month-high.

Iron Ore Key Indicators:

• Platts62 $131.85, +2.30, MTD $125.40. The current market started to worried about the exchange control from China would bring market back to cautious sentiment. Fixed price still dominate the market from late half of last week to early half of this week. The import margin vanished again for mid-grade and high grade as the quick push on iron ore index, which squeezed PBF premium to a $0.4-0.7 area. Port trades volume recovered, however be aware of low pig iron growth could become resistance factors of the fast growth.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 21st)

• Futures 115,818,700 tons(Increase 2,383,300 tons)

• Options 86,335,100 tons(Increase 2,089,500 tons)

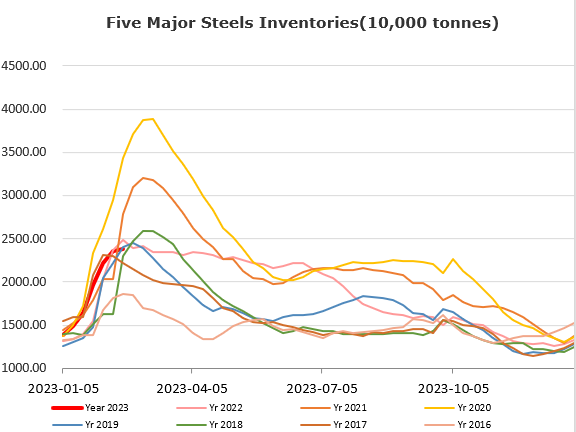

Steel Key Indicators:

• MySteel estimated mid-February crude steel production at 2.8477 million tons on daily basis, up 5.8% from early February, up 20.4% on the year.

Coal Indicators:

• The clearance of coals from port Ceke expected to reach 20 million tons, Australia coal production expected to increase 10.1 million tons. Thus, the coal expected to have a loose supply in 2023 in Asia.