Verdict:

• Short-run Neutral to Bearish.

Macro:

• According to data from the China Association of Automobile Manufacturers, in January, the production and sales of commercial vehicles reached 327,000 and 324,000 respectively, a decrease of 10.7% and 11.1% month on month, and a year-on-year increase of 66.2% and 79.6%, respectively.

Iron Ore Key Indicators:

• Platts62 $121.95, -6.85, MTD $128.25. The fundamental was similar to previous trading day. Iron ore saw a stable supply in Q1, with all potential logistic disruption recovered in February. The high stocks in both mills and port added to the pressure on current price. Most of traders indicated that they were waiting for the politburo to come in March. As a result, late February and early March should see few stimuluses.

• BOM news said ex-tropical cyclone Lincoln expected to impact northwest areas of Australia on Thursday night. Port Dampier, which mostly shipped iron ore from Rio Tinto, started to clear vessels.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 21st)

• Futures 116,102,800 tons(Increase 1,711,200 tons)

• Options 110,852,300 tons(Increase 13,356,600 tons)

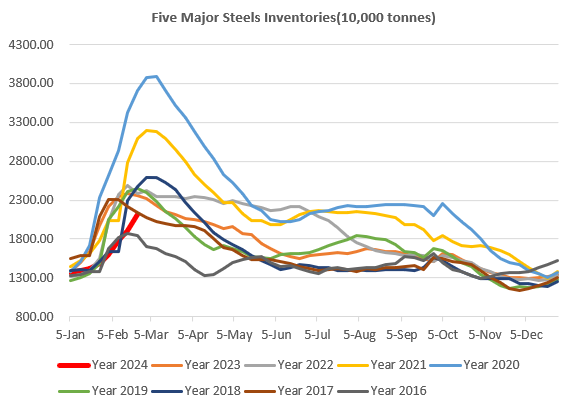

Steel Key Indicators:

• China Tangshan steel mills billet cost at 3764 yuan/ton, down 19 yuan/ton, average loss for steelmaking was 214 yuan/ton.

Coal Indicators:

• China 110 coke washery plants operation rate at 58.8%, up 10.18% on the week.

• The production cut of China Lu’An Group was heard with limited impact in prime coal market. The FOB coking market inched down hearing some reselling interests.