Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. Federal president Jerome Powell indicated that the consumer price was the key of economy. To maintain a stable price was the responsibility of U.S. Federal. The realization of 2% inflation target along with the credit risk would bring long-term panic to economy. Thus, interest rates potentially stay at a less higher level.

Iron Ore Key Indicators:

• Platts62 $108.40, -1.90, MTD $106.87. Seabonre iron ore inquiries disappeared as the U.S. debt risk crushed down the risk appetite of assets. Moreover, the negative import margin create pressure to buy seaborne. However, the Tangshan supply of high grade concentrates were tight in May and June. Thus, seaborne interests expected to maintain in a continual mode during the current weeks instead of vanishing.

SGX Iron Ore 62% Futures& Options Open Interest (May 19th)

• Futures 93,723,600 tons(Increase 1,117,300 tons)

• Options 112,170,300 tons(Increase 1,045,000 tons)

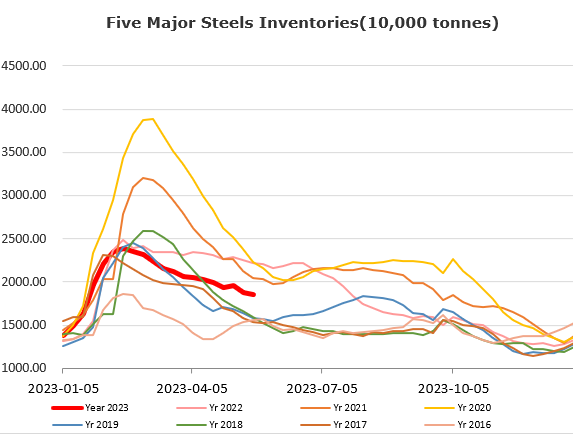

Steel Key Indicators:

• China Shasteel Group decreased the ex-factory price of rebar in late May by 50 yuan at 3950 yuan/ton.

Coal Indicators:

• China physical coke cut 50 yuan/ton for the eighth round. However market participants expected a support, because the previous drop of a single round was 100 yuan/ton.