Verdict:

• Short-run Neutral.

Macro:

• China NBS: In April, China’s crude steel production was 85.943 million tons, a year-on-year decrease of 7.2%. Crude steel production from January to April was 34.3672 million tons, a year-on-year decrease of 3.0%. China’s iron ore production reached 87.904 million tons, a year-on-year increase of 11.5%. The cumulative production from January to April was 36.887 million tons, a year-on-year increase of 14.0%. In April, China’s coal production was 37.1665 million tons, a year-on-year decrease of 2.9%; The cumulative production from January to April was 1475.790 million tons, a year-on-year decrease of 3.5%.

Iron Ore Key Indicators:

• Platts62 $120.70, +2.20, MTD $117.28. There were active trades on seaborne iron ore market yesterday including fixed price trade for MACF at $116.2 and float price PBF traded at index + $0.45. However enquiries became less as the hike on the futures market left no landing margin. Physical traders were holding watch and see mode.

SGX Iron Ore 62% Futures& Options Open Interest (May 21st)

• Futures 120,024,500 tons(Decrease 24,494,700 tons)

• Options 144,519,200 tons(Increase 2,969,500 tons)

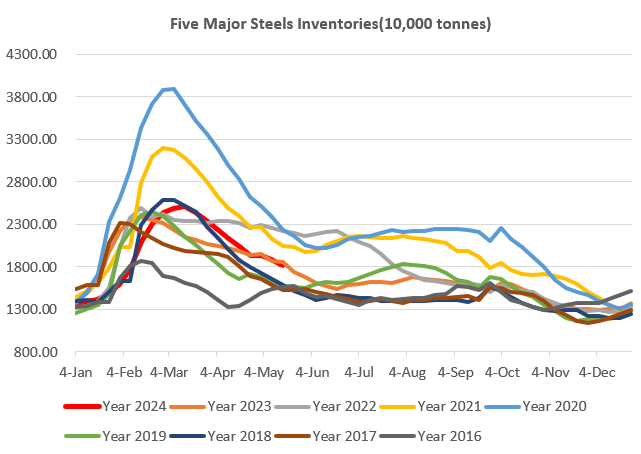

Steel Key Indicators:

• China HRC FOB Tianjin at 535 yuan/ton, up $10 on the week.

Coal Indicators:

• The Australia coking coal market saw a strong demand in July market while there was almost no demand for June cargoes.

• China cut the first round of coke price by 100-110 yuan/ton.