Verdict:

• Short-run Neutral.

Macro:

• China 1-Year LPR down 10 bps to 3.35%, 5-year LPR down 10 bps at 3.85%.

• WTI crude oil futures settled at $82.63/barrel, refreshed the lowest since mid-June.

Iron Ore Key Indicators:

• Platts62 $104.35, -0.95, MTD $108.61. China 45 ports iron ore inventories at 151.31 million tons, up 1.42 million tons on the week, up 25.90 million tons on the year. Daily evaluations at 3.0972 million tons, down 1,600 tons on the week, down 41,300 tons on the year. Australian source iron ore inventories at 71.08 million tons, up 955,800 tons on the week, up 13.84 million tons on the year. Brazil source iron ore inventories at 49.25 million tons, up 1.19 million tons, on the week, up 5.34 million tons on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 19th)

• Futures 111,220,500 tons(Increase 1,514,300 tons)

• Options 158,651,000 tons(Increase 515,000 tons)

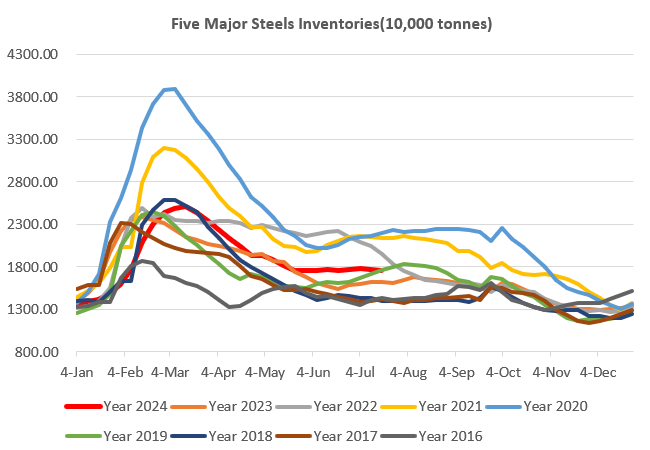

Steel Key Indicators:

• Yonggang Group lowered rebar price delivered in late July by 50 yuan/ton to 3500 yuan/ton. Shagang Group lowered rebar price by 100 yuan/ton to 3770 yuan/ton.

• During past week, MySteel 247 blast operation rate at 82.63%, up 0.13% on the week. Blast utilisation rate 89.62%, up 0.92% on the week. The 87 independent EAFs average utilisation rate at 44.98%, up 0.24% on the week.

Coal Indicators:

• The FOB coking coal market remained weak because the reselling interest from end-users increased overall supplies of the market.

• China steel mills rejected the second round of price increase proposed by cokery plants.