Verdict:

• Short-run Neutral.

Macro:

• The unchanged 5-year LPR versus 10 bps decrease on 10-year LPR indicated a limited liquidity of China commercial banks. However commercial banks need to maintain the resilience of liquidity supply to real entities. The market expect more rate cuts in the following months in H2.

Iron Ore Key Indicators:

• Platts62 $110.35, +1.00, MTD $105.94. The high operation rate became a strong support for iron ore demand. MACF was sold at fixed price at $107.35, up $1.2 on the day. MACF was also sold at a $0.3 premium based on September Index. However JMBF discount based on September index narrowed from $4 to $3.6. PBF saw a less popularity on ports and seaborne because of the decreased ferrous content and slight higher moisture.

• Australia and Brazil total delivered 26.676 million tons of iron ore last week, up 885,000 on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 21st)

• Futures 118,038,100 tons(Increase 729,500 tons)

• Options 107,793,400 tons(Increase 1,646,000 tons)

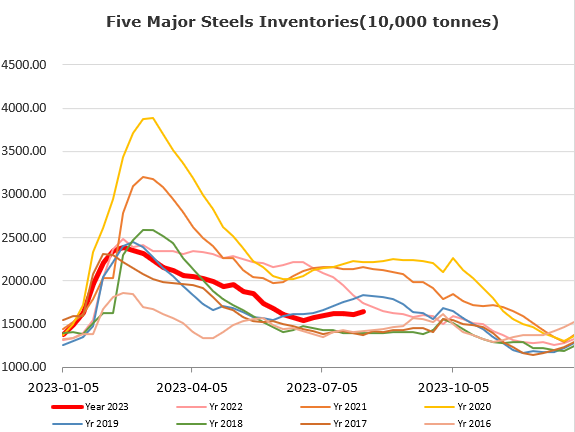

Steel Key Indicators:

• MySteel estimated that the crude steel production in mid- August at 30.145 million tons, up 0.91% from early August, up 10.39% on the year.

Coal Indicators:

• The first round of Chinese domestic coke price cut at 100- 110 yuan/ton were proposed by steel mills from Tianjin and Xingtai.

• A coal mine accident occurred in Taiyuan, China. MySteel estimated a 60,900 tons of coal production impact.