Market Verdict on Iron Ore:

· Oversold in short-run.

Macro

· China PM Li Keqiang held conference to punish illegal speculation on coal market and prevent the price transmission from commodities to downstream, and avoid cost increasing on mid-small capital company.

· China Zhejiang Province downgrade the electricity consumption level from C to B, indicating the power supply was becoming sufficient.

· Indonesia president Joko Widodo indicated that Indonesia planned to stop export commodities to increase local processing businesses on resources and new businesses booming. The prohibition export list included nickel, tin, copper and unprocessed minerals related to batteries materials and aluminum industries.

Iron Ore Key Indicators:

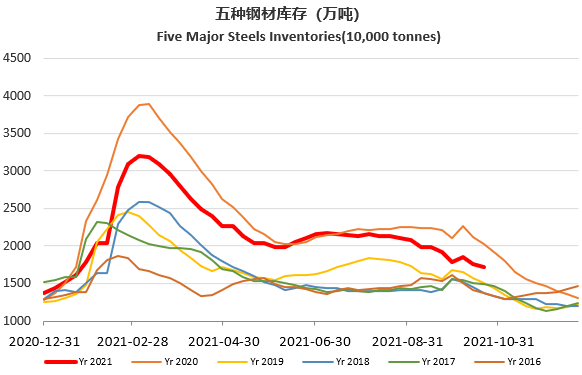

· Platts62 $117.50, -6.95, MTD $122.89. Iron ore SGX and DCE both corrected massively during yesterday and over Asian night session after a underestimated apparent steel consumption data came out in the early afternoon yesterday. Moreover the electricity supply was becoming less tight and major provinces started industrial activities. The mills purchase of iron ores cool down seasonally approaching November, plus the steel growth rate restriction by the year-end turned away the interest from physical traders in general in the last two months of the year 2021. Iron ore DCE might reach bottom area first, but Iron ore SGX potentially has more room to drop.

· Anglo-American produced 16.89 million tones of iron ore in south Africa and Brazil, up 8% from Q2, up 15% y-o-y.

· MySteel 45 ports iron ore inventories at 140.45 million tonnes, up 1.47 million tonnes w-o-w. Daily evacuation 2.76 million tonnes, up 89,100 tonnes w-o-w. Australia iron ore 67.99 million tonnes, up 879,000 tonnes w-o-w. Brazil iron ore 46.50 million tonnes, up 208,000 tonnes w-o-w. 202 ships at ports, down 6 w-o-w.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 21st)

· Futures 72,276,200 tonnes(Increase 862,200 tonnes)

· Options 85,079,000 tonnes(Increase 45,000 tonnes)

Daily Virtual Steel Mill Report 22/10/21(Cont’d)

Steel Key Indicators

· Jiangsu billet has created the biggest one day drop by 320 yuan/tonne yesterday.

· Linfen city, Shanxi, China: winter production cut impact 17,000 tonnes of pig iron daily, blast utilization rate decrease to 57%.

Coal Indicators

· China price law would increase coal market price inspection and research in the price control practices by following the mining cost, trade flow cost and special research.

· China Energy Bureau required to increase supply of coal in the Q4 and increase both domestic production and import, following the coal price restriction of 1800 yuan/tonne of 5500kcal coal at northern ports.