Verdict:

• Short-run Neutral.

Macro:

• US Q3 GDP annual rate at 4.9%, less than expected 5.2%. Q3 PCE consumer price index up 2% on the year, lower than expected 2.3%.

• China tax council announced a new list of tax exemption and preference lists covering as many as 8957 items of commodities, including some high-end steels.

Iron Ore Key Indicators:

• Platts62 $138.00, +3.05, MTD $135.01. Corex 170kt Fe61% PBF at $135.5 yesterday, for late January laycan. The miners have to be cautious on the timing of arrivals. Some traders indicated the demand raised for the Chinese holiday restock. Moreover, the saving rate cut first time in the three months of China stimulate a sentiment on iron ore market. Although Red Sea disruption only impact tiny on iron ore shipment, the impact on freight and fuel oil would indirectly raise iron ore valuation in long run.

• The 45 iron ore ports inventories at 118.87 million tons, up 3.02 million tons on the week, however 14.499 million tons higher than last year. Evacuation at 2.5495 million tons, down 513,900 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 21st)

• Futures 125,837,500 tons(Increase 2,652,400 tons)

• Options 108,893,700 tons(Increase 1,515,000 tons)

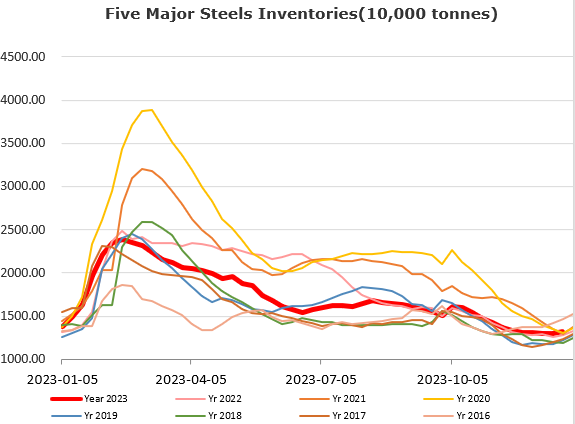

Steel Key Indicators:

• Tangshan billet cost 3884 yuan/ton, up 32 yuan/ton. The steel production loss at 264 yuan/ton.

Coal Indicators:

• The market saw lower tradeable levels on PLVs from $310-330/mt to $300 – 320/mt during past 2-3 days. The market has split views on seaborne coking coal.

• China cokery plants proposed the fourth rounds of price hike, however mills and traders were rejecting the price increase due to thin margin and lower steel demand.