Market Verdict on Iron Ore:

• Neutral.

Macro

• China PM Li Keqiang held a conference to enhance tax return and tax exemption policy to support economy growth.

• European Central Bank Committee Olli Rehn indicated that central bank potential start interest rate increase by the end of this year or the beginning of the year 2023.

Iron Ore Key Indicators:

• Platts 62%: $147.90 (-3.45) MTD $150.869. China Tangshan and Shandong portside steel mills’ transportation were blocked caused by Omicron spread. Downstream in northern and eastern market were frozen. Lump demand is replaced by the active portside concentrates. Low grade and heavy discount fines such as SSF gathered more buying interests compared with mid-grade. MACF discount widened $1.2 to $8.5 because of inventory grew on ports. High grade demand decreased both because of the increasing supply from Vale and sharply narrowed steel margin.

• MySteel 45 port previous week iron ore arrived 21.93 million tonnes, up 929,000 tonnes w-o-w. Northern six ports arrivals at 10.23 million tonnes, up 281,000 tonnes w-o-w.SGX Iron Ore 62% Futures& Options Open Interest (Mar 21st)

• Futures 90,342,900 tonnes(Increase 98,700 tonnes)

• Options 87,086,300 tonnes(Increase 1,032,500 tonnes)

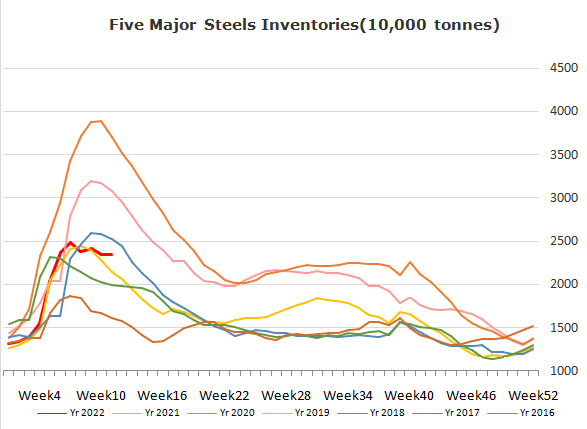

Steel Key Indicators

• Some Tangshan mills stopped operation because of the shortage on raw materials. Most of the steel mills indicated that would start blast furnace maintenance if the material shortage last one more week.

Coal Indicators

• Australia premium low coking coal FOB price kept stable over the late half of last week. The supply on laycans after two months are relaxed, however the market was still very tight in the current few weeks. March22/Jun22 spread expanded from $110 in the first trading day of March to $170 last week.