Market Verdict on Iron Ore:

• Neutral to bearish.

Macro

• CNH depreciated 300 basis points at 6.45, refreshed six-month records.

• U.S. Federal official Mary Darly indicated that the 50 basis points interest rate increase was “very possible” in May. U.S. Federal potentially to raise interest rate to a neutral level.

• Germany Annalena Baerbock announced that Germany would stop importing Russian crude oil from next year during her visit to Baltic countries.

Iron Ore Key Indicators:

• Platts62 $150.05, -0.65, MTD $154.68. One laycan of PBF was traded at fixed price yesterday, which was rarely seen over the last two months. The fixed price laycan was traded 10 days ago. However seaborne trades were sluggish in general. Tangshan area reported that at least12-13% of steel capacity were stopped due to the pandemic. The city announced recovery industrial activities today, however the untimely temporary closure expected to become a normal status in the coming few weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 21st)

• Futures 82,270,300 tonnes(Increase 144,700 tonnes)

• Options 83,944,500 tonnes(Increase 60,000 tonnes)

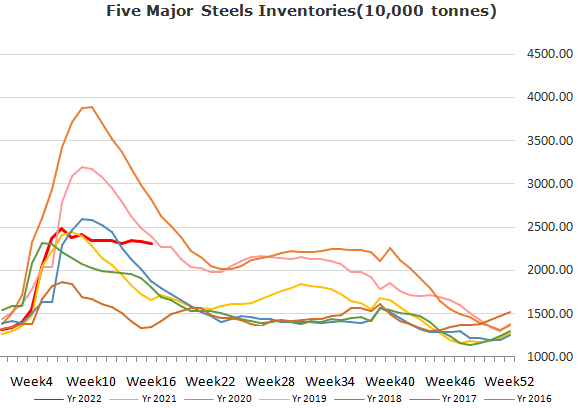

Steel Key Indicators

• MySteel researched 40 EAFs avreage cost 5072 yuan/ton, up 37 yuan/ton. Average profit 29 yuan/ton, down 6 yuan/ton.

Coal Indicators

• China Hebei steel mills accepted coke price increased by 200 yuan/ton for the sixth rounds, accumulated up 1200 yuan/ton.

• The second biggest coal port Ceke in Mongolia will open in the April 25th. The port has closed for six months previously due to the pandemic spread.