Market Verdict on Iron Ore:

· Neutral.

Macro

· OECD predicted that the global economic increase at 5.7% in the year 2021, G20 growth rate at 6.1%, down 0.1% and 0.2% respectively from the last expectation in May. China growth rate at 8.5% in the year 2021, and 5.8% in the year 2022, unchanged from previous prediction.

· U.S. Treasury secretary Yellen warmed that If the U.S. Congress failed to immediately raise the federal government’s debt ceiling or suspend its entry into force, the federal government may default on its debt in October this year and will cause widespread “economic disaster”.

Iron Ore Key Indicators:

· Platts62 $94.00, unch, MTD $122.77.

· India iron ore production up 30-35% expected in the fiscal year 2021/2022.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 21st)

· Futures 79,653,500 tonnes(Increase 591,100 tonnes)

· Options 91,367,500 tonnes(Increase 825,000 tonnes)

Steel Key Indicators

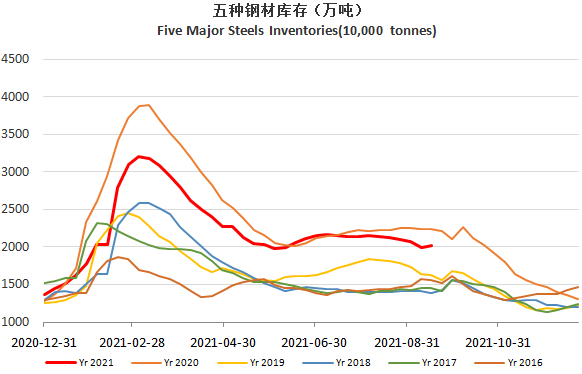

· Steelbank construction steels inventory 7.26 million tonnes, down 4.05% w-o-w. HRC inventories 2.85 million tonnes, up 0.91% w-o-w.

Coal Indicators

· According to the National Development and Reform Commission, relevant departments require to improve the safe coal storage system of coal-fired power plants, reduce the coal storage standard of power plants in peak seasons, and keep the bottom line of coal storage safety for 7 days. The available turnover days of coal stock in the power plant shall be kept at 7-12 days in the peak season of power coal consumption, and the upper limit of coal storage in the peak period of coal consumption shall not be higher than 12 days.

· 5.8 manitude quake hits Australia Victoria, without announcement of casualties as well as impact on port activities.