Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. FOMC indicated that most of officials had saw the positive effect of slower hike. Thus, most of officials are voting for 25 bps hike. The U.S. Federal believed that the inflation risk was in general controllable.

Iron Ore Key Indicators:

• Platts62 $130.60, -1.25, MTD $125.73. Fixed price still dominate the market from late half of last week to early half of this week. The import margin vanished again for mid-grade and high grade as the quick push on iron ore index, which squeezed PBF premium to a $0.4-0.7 area. Port trades volume recovered, however be aware of low pig iron growth could become resistance factors of the fast growth.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 22nd)

• Futures 116,201,800 tons(Increase 383,100 tons)

• Options 88,295,100 tons(Increase1,960,000 tons)

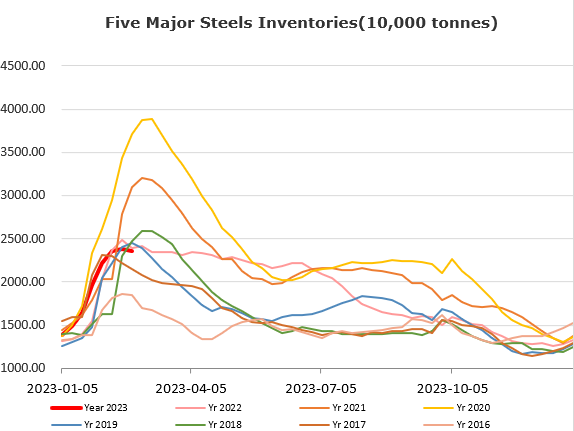

Steel Key Indicators:

• Tangshan average billet cost 3953 yuan/ton, up 58 yuan/ton. Production loss at 23 yuan/ton in blast furnace.

Coal Indicators:

• The highest bid over Saraji and Peak Downs PLV were heard at $390/mt.

• An open cut coal mine in China innter-Mongolia province reported a large-area collapse, caused 2 deaths, 6 injuries and many lost. The local government expected to start safety maintenance for all coal mines in the province.