Market Verdict on Iron Ore:

• Neutral to Bearish.

Macro:

• U.S. Federal hiked 25 bps interest rate to reach 4.75- 5%, as expected from Fed tools. The market expected a interest decrease before the end of 2023 to stimulate economy growth.

• U.S. lowered GDP growth rate to 0.4% in 2023, previously estimated at 0.5% in last December. U.S. lowered GDP growth rate from 1.6% to 1.2% in 2024.

Iron Ore Key Indicators:

• Platts62 $121.40, -3.30, MTD $128.45. There is resilient demand on the downstream given some bearish sentiment hit paper market early this week. BHP sold $122.65 as a fixed trade yesterday with April laycan. Market participants believed that there should be support on $115-120 range. PBF float also improved slightly from $0.85 to %0.90, which benefit the buyer if based on a lower index in April.

• Guinea government posted on a social media that the Simandou iron ore project come to a “materialised” stage of development. The mining area could theoretically produce 120 million tons of iron ore under full capacity.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 22nd)

• Futures 111,937,100 tons(Decrease 374,500 tons)

• Options106,661,600 tons(Increase 835,000 tons)

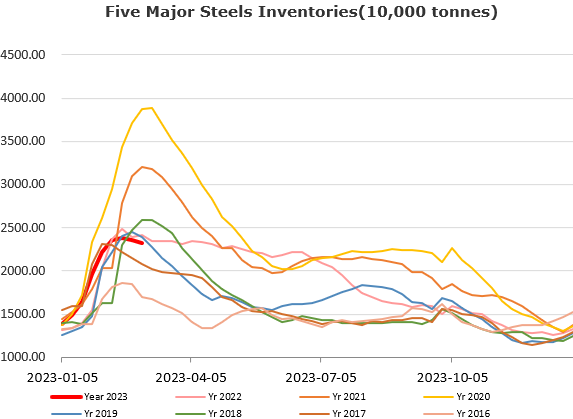

Steel Key Indicators:

• Tangshan average billet cost 3946 yuan/ton, down 43 yuan/ton. Average production loss at 46 yuan/ton.

Coal Indicators:

•Australia FOB coking coal index maintained stable, with tradeable range from $320 – 340/mt.