Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• St. Louis Fed chairman James Bullard said the Fed should implement a series of aggressive interest rate hikes in advance and raise interest rates to 3.5% by the end of the year. If successful, Fed will effectively lower inflation and may cut interest rates in 2023 or 2024.

Iron Ore Key Indicators:

• Platts62 $136.25, +6.85, MTD $133.16. Seaborne PBF obtained growing interests, in particular after price correction. However buyers are still preferring MACF. China MACF at port areas decreased fast. South Flank mines expected to ship more MACF to China. 65-62 spread remained narrow around $23 because of the thin steel margin. Some traders indicated that mills resold Carajas fine considering the cost. SSF discount narrowed for consecutive months while SSF/PBF ratio also narrowed, indicating the low grade fines are favorable options for end-users to optimise cost-efficiency.

• India increased iron ore export tariff from 45- 50% from May 22nd. China imported 44.67 million and 33.42 million tons of India iron ores in 2020 and 2021, account for 3.8% and 3% of total China import respectively. MySteel estimated that China imported iron ore would decrease significantly to 20million tons in 2022. However Indian pellets contributed 30% of total China pellets import market, which potentially increase the pellet premium in the near future. In addition, China mills increased the low grade Indian fines in Q1 and early Q2, tariff increase would narrow the low grade discount from India.

SGX Iron Ore 62% Futures& Options Open Interest (May 20th)

• Futures 78,466,300 tons(Increase78,466,300 tons)

• Options 75,808,000 tons(Increase 429,500 tons)

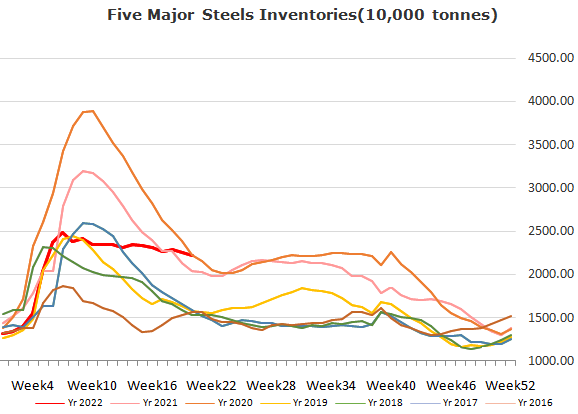

Steel Key Indicators

• Tangshan billet cost 4664 yuan/ton, down 57 yuan/ton w-o-w. Average profit – 144 yuan/ton, down 63 yuan/ton.

Coal Indicators

• India decreased coking coal and coke import tariff from 2.5% and 5% to 0. India increased export HRC with 600mm width and wider HRC tariff from 0% to 15%.