Verdict:

• Short-run Neutral.

Macro:

• A package of preferential tax policies to support healthy development of capital market is released by China, aiming to reduce tax burdens over enterprises and individuals.

Iron Ore Key Indicators:

• Platts62 $113.30, +2.95, MTD $106.43. The high production of steels, low port inventories and deliveries are supporting current iron ore price. The production cut yet to see any strict process in August. However, there was no seaborne concentrates traded through primary or secondary market.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 22nd)

• Futures 120,205,200 tons(Increase 2,167,100 tons)

• Options 109,643,400 tons(Increase 1,850,000 tons)

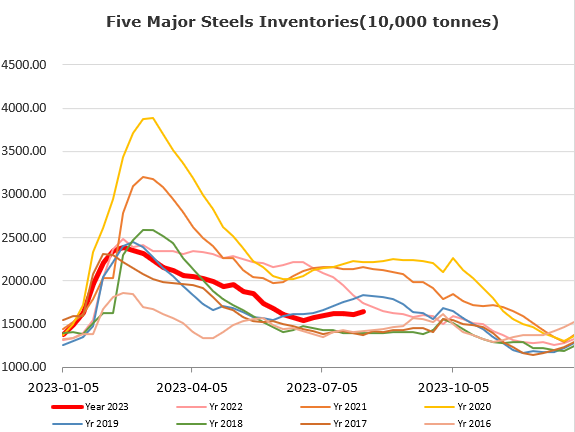

Steel Key Indicators:

• CISA statistics indicated member steel enterprises total produced 22.15 million tons of crude steels in mid-August, daily production at 2.215 million tons, up 2.89% from early August.

Coal Indicators:

• China cokery plants rejected the first round of price decrease proposed by northern steel mills.