Verdict:

• Short-run Neutral to Bearish.

Macro:

• The US Federal Reserve governor, Loretta Mester stated that the benchmark interest rate was approaching peak level, and decision-makers need to be “flexible” in their actions. Bank of America Global Research has postponed the Fed’s final rate hike forecast to December.

• Pan Gongsheng, the governor of the People’s Bank of China, stated that the bank would continue to implement a prudent monetary policy, further promote financial institutions to lower actual loan interest rates, and lower the comprehensive financing costs of enterprises and personal consumption credit costs.

Iron Ore Key Indicators:

• Platts62 $115.25, -4.10, MTD $118.34. The market was concerning the low steel margin would trigger some proactive production curb. PBF was traded at December Index + $4.4, which was lower than last premium a week ago at $5.1- 5.2 area.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 20th)

• Futures 135,127,200 tons(Increase 3,067,700 tons)

• Options 118,960,100 tons(Increase 2,325,000 tons)

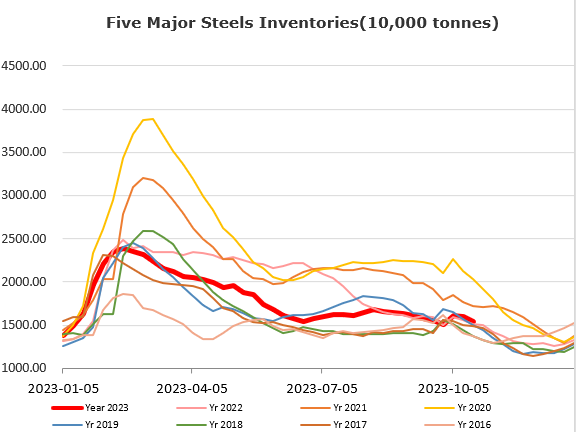

Steel Key Indicators:

• Shagang Group decreased ex-factory rebar price by 100 yuan/ton to 3850 yuan/ton. Shangang Group decreased scrap price by 30 yuan/ton.

• Tangshan started production restrictions on independent steel rolling mills.

• MySteel 87 EAFs average utilisation rate at 50.64%, up 1.22% on the week, up 1.19% on the year. MySteel 247 steel mills utilisation rate at 90.62%, down 1.31% on the week, down 2.36% on the year.

Coal Indicators:

• The FOB Australia saw a non-independent trade reported at $342/mt for PMV Goonyella C, which pull down index at slight lower level.

• China coke trader indicated a current support at coking coal price level given a tight domestic supply and low port stocks.