Verdict:

• Short-run Neutral.

Macro:

• S&P indicated that the U.S. Service PMI in August at 51.0, refreshed the slowest increase since February. Manufacturing PMI in August at 47.0, down from 49.0 in July, created a four consecutive month drop.

Iron Ore Key Indicators:

• Platts62 $116.50, +3.20, MTD $107.06. BHP narrowed JMBF discount from $4.5 to $4 in September. MACF maintained unchanged discount at 0.25%. The current narrowed steel margin supported the demand on discount concentrates.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 23rd)

• Futures 123,610,600 tons(Increase 3,405,400 tons)

• Options 111,848,400 tons(Increase 2,205,000 tons)

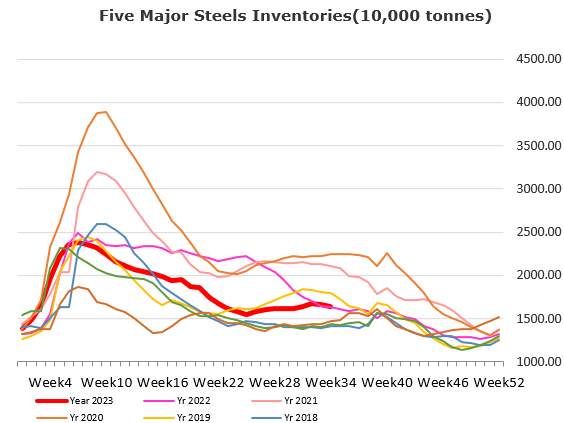

Steel Key Indicators:

• Tangshan average billet cost 3598 yuan/ton, up 32 yuan/ton on the week, average loss at 48 yuan/ton.

• World Steel Association statistic indicated that total 63 member countries crude steel production at 158.5 million tons, up 6.6% on the year.

Coal Indicators:

• There was a 35,000mt Riverside PMV Australia FOB cargoes sold to India end-users at $259.