Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. Federal was considering lower the December interest hike to 50 bps from 75 bps, however the final interest rate would increase in 2023. At least 6 ECB officials support a 75 bps interest hike by the end of 2022.

• China first three quarter GDP growth rate 3% year-on-year, up 0.5% from H1. Q3 GDP 3.9%, up 3.4% from Q2, 0.9% lower than Q1.

Iron Ore Key Indicators:

• Platts62 $93.00, +1.60, MTD $95.16. PBF float premium massively corrected from $2.35 to $1.05 last Friday, because of the weakened Chinese steel margin lowered demand on high premium. Mills and traders were sensitive about the float premium. However Chinese pig iron production was stablised on a 2.4 million tons during the current three weeks, a potential high in H2 2022. BHP narrowed MACF discount in November from 2.5% to 0%, narrowed JMBF discount from 6.5% to 4.5%. Thus, Chinese steel mills indicated that it would take more times to get acquainted with the increased cost from BHP sources.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 21st)

• Futures 100,112,700 tons(Increase 1,445,900 tons)

• Options 87,232,200 tons(Increase 580,300 tons)

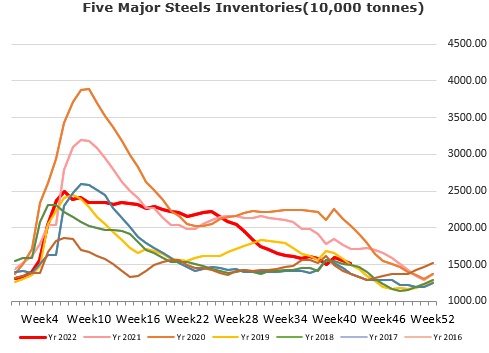

Steel Key Indicators:

• China 85 EAFs average operation rate at 57.95%, up 5.23% on the month, down 10.82% on the year.

Coal Indicators:

• FOB Australia coking coal rebounded significantly by $5 to $299, concerning the supply tension after BOM reported a heavy rainfall of 100mm in Gladstone Port. The indicative tradeable value of Goonyella and Peak Downs was ranged from $296 – 307. A 75,000mt HCCA Branded offered at $350, for early January laycan.

• Australia total exported 262 million tons of coals, down 13 million tons(or 4.7%) on the year. Thermal coal exported 141 million tons, down 5.4% on the year. Coking coal exported 121 million tons, down 3.9% on the year.