Verdict:

• Short-run Neutral.

Macro:

• China sovereign wealth fund Central Huijin Investment Ltd. Said it bought exchange-traded funds in late Monday, which was the second time in the month.

Iron Ore Key Indicators:

• Platts62 $115.55, +0.30, MTD $118.17. The market was concerning the low steel margin would trigger some proactive production curb. PBF was traded at December Index + $4.4 last Friday and down to $4.1 on Monday, which was lower than last premium a week ago at $5.1- 5.2 area.

• China 45 ports iron ore arrivals at 22.796 million tons, down 4.584 million tons on the week. Six northern ports arrivals at 10.094 million tons, down 1.493 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 23th)

• Futures 135,978,200 tons(Increase 851,000 tons)

• Options 119,210,100 tons(Increase 250,000 tons)

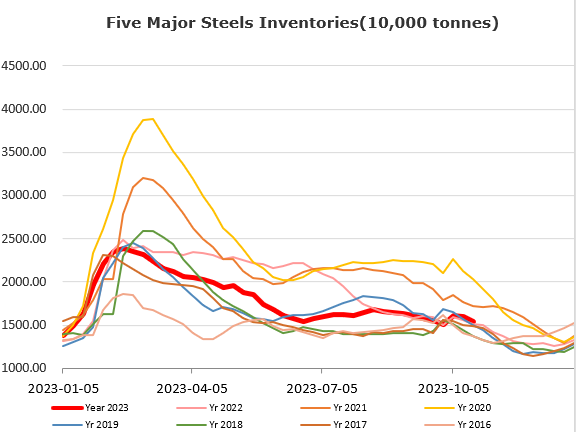

Steel Key Indicators:

• Nucor, Cliffs push HRC price to $800/st. Two Canadian flat steel have increased their spot pricing.

Coal Indicators:

• The FOB Australia saw several trades reported arround $342-343/mt for PMV and PLV at stable mode.