Market Verdict on Iron Ore:

• Bearish.

Macro

• Kyiv says multiple sites attacked across country.

• Europe central bank Vice President said the central bank would consider make adjustments on the asset purchase after the termination of PEPP in this March. In addition, the central bank would consider increasing interest rate.

Iron Ore Key Indicators:

• Platts62 $138.05, +1.30, MTD $143.09. Ukraine miner metiinvest, Ferro-Expo and Arcelor Mittal Kryviy Rih currently indicated the production was normal. At the same time, all of them had prepared contingency plans. A hongkong trader offered slid from $139 to 137.6 for PBF, still untraded. Fe61.5% PBF deals were still traded around 870- 875 yuan/wmt during this week.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 23rd)

• Futures 94,933,200 tonnes(Increase 1,362,500 tonnes)

• Options 58,920,800 tonnes(Increase 1,539,000 tonnes)

Steel Key Indicators

• 64 World Steel Association member countries total crude steel production at 155 million tonnes in January, down 6.1% y-o-y.

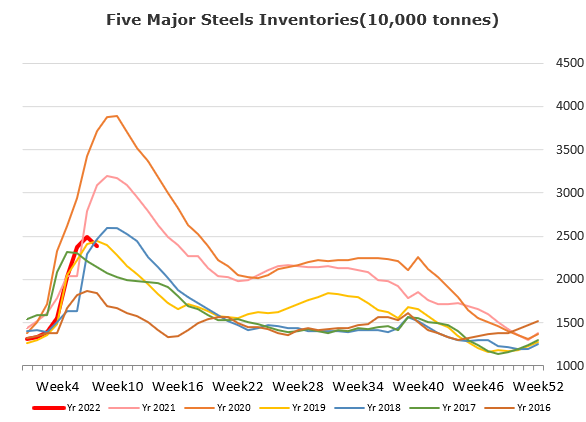

• Ganggu construction steel production 4.38 million tonnes, up 175,100 tonnes. Mills inventory 6.61 million tonnes, up 17,700 tonnes w-o-w. Circulation inventory 12.65 million tonnes, up 1.11 million tonnes w-o-w.

Coal Indicators

• The China National Development and Reform Commission organized relevant local government departments, coal enterprises, ports and coal price information institutions to hold meetings to compare and verify the price sampling information closely and in details. After verification, price samples mainly have the following problems: first, the source of information is untrue. The sampling source enterprises of port coal prices released by some information institutions have not established accounts in the port. Second, the price reported was differently from actual transaction price. Some information institutions took the artificially high quotation of traders as the sampling basis.