Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. Markit May PMI 48.5, less than expected 50, refreshed the lowest of last three months. Eurozone PMI May at 44.6, last 45.8.

• The third round of negotiations between the White House and Congressional leadership continued with no resolution, although both sides described that the meeting was “productive”.

Iron Ore Key Indicators:

• Platts62 $97.35, -5.05, MTD $105.93. Vale Q3 Direct Reduction of Iron ore Pellet up $15/dmt to $60. Term contracts discount widened. JMBF discount increased from 3% to 4.25% based on IODEX June index. MACF was unchanged. Seabonre iron ore inquiries disappeared as the U.S. debt risk crushed down the risk appetite of assets. Seaborne market saw active inquiries in mid-grad iron ores, MACF traded at fixed price at $93.8.

SGX Iron Ore 62% Futures& Options Open Interest (May 24th)

• Futures 100,287,400 tons(Increase 2,934,100 tons)

• Options 113,087,300 tons(Increase 182,000 tons)

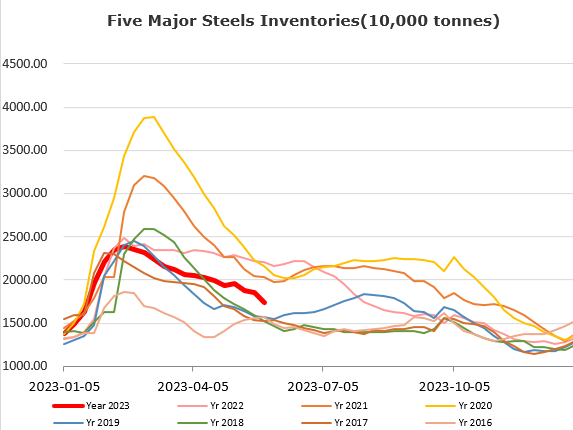

Steel Key Indicators:

• World Steel Association statistic indicated that global crude steel production down 2.4% to 161.4 million tons. Jan-Apr global steel production down 0.3% to 622.7 million tons.

Coal Indicators:

• Australia coking coal demand was sluggish after the restocking activities from India and China ended from April to May. China physical coke market has dropped 750- 830 yuan/mt since March.