Verdict:

• Short-run Neutral.

Macro:

• WTO indicated that the global trade should recover gradually in Q2 2023, and should stablise in Q3. The 1.7% growth rate of world trade in 2023 is approachable.

• The U.S. jobless claims last week reached 230,000, est. 240,000, last 239,000.

Iron Ore Key Indicators:

• Platts62 $114.50, -2.00, MTD $107.50. BHP narrowed JMBF discount from $4.5 to $4 in September. MACF maintained unchanged discount at 0.25%. The current narrowed steel margin supported the demand on discount concentrates.

• Ministry of Industry and Information Technology and other seven departments in China carried out early warning of supply and demand of iron ore in different levels with “red, yellow and blue”, and strengthen spot market supervision during the period.

• MySteel 45 iron ore ports inventories 120.32 million tons, down 185,100 tons on the week. Daily evacuation 3.28 million tons, up 14,700 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 24th)

• Futures 125,132,900 tons(Increase 1,522,300 tons)

• Options 114,342,400 tons(Increase 2,494,000 tons)

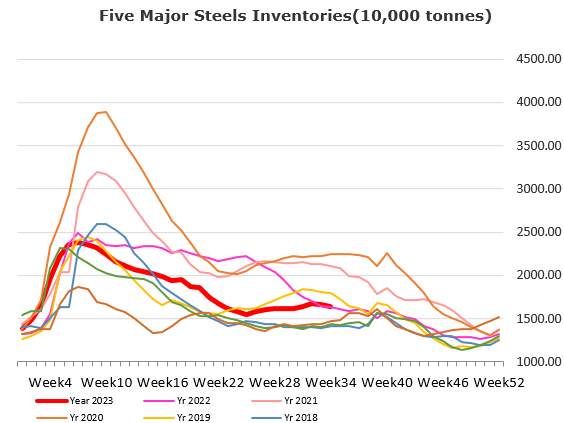

Steel Key Indicators:

• Tangshan rolling mills implemented steel production policies. According to Mysteel’s research data, it is estimated that the operating rate of 35 steel rolling mills in Tangshan area will decrease from 51.06% to about 25%, with an estimated daily production impact of about 40,000 tons. Several areas in China have already implemented official production restriction yesterday.

Coal Indicators:

• The FOB Australia market entered a quiet mode yesterday. However prospective buyers were heard to bid up on the September delivered PHCC, because of the supply tightness.