Verdict:

• Short-run Neutral to Bearish.

Macro:

• China and US will officially launch two new working groups on economic and financial issues, aiming to provide a regular policy communication forum for the two countries and will hold regular meetings.

• US Federal Reserve Governor Bowman stated that the inflation was too high and further interest rate hikes may be appropriate. Federal Reserve Governor Daley stated that it is unlikely to achieve the 2% inflation target by 2024.

• The Bank of Japan announced that it would continue to implement the ultra loose monetary policy, maintain the short-term interest rate at a level of negative 0.1%, and maintain the long-term interest rate at about zero by purchasing long-term treasury bond.

Iron Ore Key Indicators:

• Platts62 $123.60, +3.75, MTD $121.46. Some traders indicated that the SSF was almost sold out at China ports. Moreover, the negative steel margin lowered the demand for premium cargoes including NHGF and PBF. Stocking for China holidays in next week approached an end. The pig iron consumption expected to decrease in late September.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 22nd)

• Futures 140,829,100 tons(Increase 2,426,400 tons)

• Options 134,587,600 tons(Increase 931,500 tons)

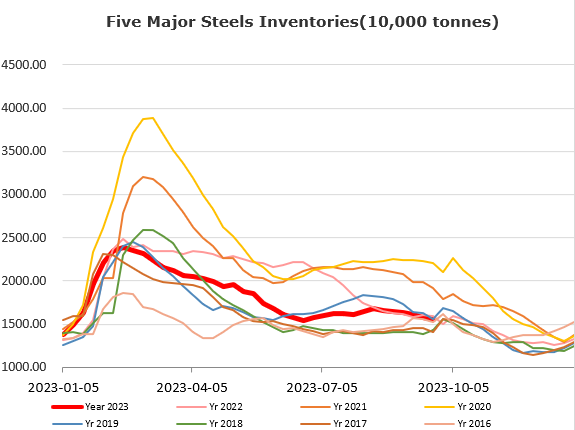

Steel Key Indicators:

• CISA statistics indicated that mid-September crude steel daily production at 2.1355 million tons, down 1.17% from early September, down 0.54% on the year.

Coal Indicators:

• Guizhou, China reported a coal mine accidents, however paper market started to become less sensitive on the news. Traders started to conern about the decreasing pig iron demand.