Market Verdict on Iron Ore:

· Neutral.

Macro

· China state council researched to support wind based electricity, solar based electricity and to increase utilize advanced smart power grid technology. To control coal, steel, electrolytic aluminum, cement, and petro-chemical projects investments. To support green and low carbon consumption program development.

· China financial department drafted the pilot version of real estate tax.

· U.S. October Markit Manufacturing PMI 59.2, created three months low. Est. 60.3. Last 60.7. U.S. Federal Reserve Chairman Powell indicated Federal potentially increase interest rate in the mid-2022 if inflation rate risk stay at high level by then.

Iron Ore Key Indicators:

· Platts 62%: $120.35 (+2.85) MTD $122.73. Iron ore seaborne interests gradually moved from October and early November to late November and December. Seaborne and port trades both becoming significantly lighter compared to Q3. Both supply and demand were weak currently. Thus iron ore potentially consolidate in a range box. Moreover the restock for pellets and lump slight decrease after the materializing of winter production curb plan of most China cities.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 22nd)

· Futures 73,561,800 tonnes(Increase 1,285,600 tonnes)

· Options 85,344,000 tonnes(Increase 265,000 tonnes)

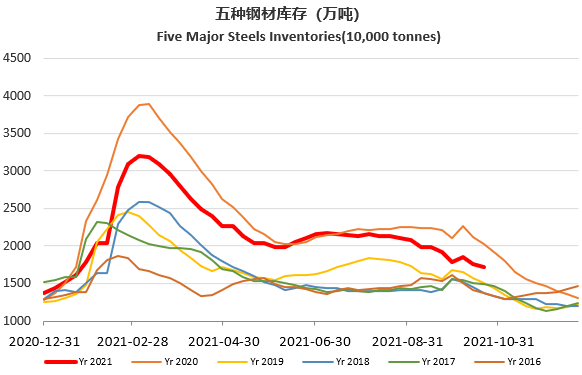

Steel Key Indicators

· Mysteel researched 247 blast furnace operation rate at 76.55%, down 1.52% w-o-w. Utilisation rate 80.05%, down 0.61% w-o-w. Daily pig iron production 2.15 million tonnes, down 16,400 tonnes.

Coal Indicators

· Major China northern and western cities started to decrease sales price of coals by 100 yuan/tonne, some areas decrease by 360yuan/tonne in 1 week.

· China NDRC held coal conferences to research in stop coal companies potential profiteering and maintain coal price in reasonable range.