Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• U.S. October Manufacturing PMI 49.9, refreshed new low since June 2020.

• Chinese January to September crude steel production 780.83 million tons, down 4.3% on the year. Total coal production 3320 million tons, up 11.2% on the year. Total crude oil production 153.75 million tons, up 3% on the year. Natural gas production 160.1 billion cubic meter, up 5.4% on the year.

Iron Ore Key Indicators:

• PBF float premium massively corrected from $2.35 to $1.05 last Friday, because of the weakened Chinese steel margin lowered demand on high premium. Mills and traders were sensitive about the float premium. However Chinese pig iron production was stablised on a 2.4 million tons during the current three weeks, a potential high in H2 2022. BHP narrowed MACF discount in November from 2.5% to 0%, narrowed JMBF discount from 6.5% to 4.5%. Thus, Chinese steel mills indicated that it would take more times to get acquainted with the increased cost from BHP sources.

• Australia and Brazil total delivered 25.116 million tons of iron ores globally last wee, up 397,000 tons on the week. Australia delivered 18.17 million tons of iron ores, up 246,000 tons on the week. Brazil delivered 6.94 million tons of iron ores, up 150,000 on the week.

• Chinese six major ports arrived 12.465 million tons of iron ores last week, up 2.825 millions on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 24th)

• Futures 100,492,700 tons(Increase 380,000 tons)

• Options 88,186,400 tons(Increase 954,200 tons)

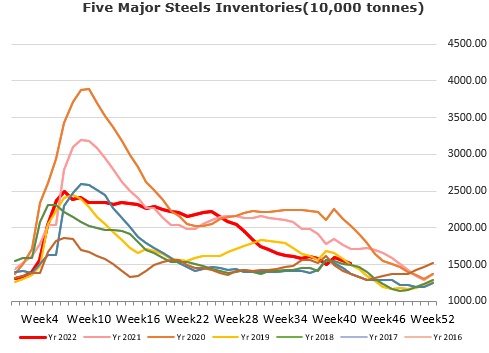

Steel Key Indicators:

• China 85 EAFs average operation rate at 57.95%, up 5.23% on the month, down 10.82% on the year.

Coal Indicators:

• FOB Australia coking coal maintained unchanged $299, concerning the supply tension after BOM reported a heavy rainfall of 100mm in Gladstone Port. The indicative tradeable value of Goonyella and Peak Downs was ranged from $296 – 307. A 75,000mt HCCA Branded offered at $350, for early January laycan.