Verdict:

• Short-run Neutral to Bullish.

Macro:

• China approved a plan to raise fiscal deficit ratio from 3% to 3.8%. The plan issued a 1 trillion yuan sovereign debt to support disaster relief and construction.

Iron Ore Key Indicators:

• Platts62 $118.55, +3.00, MTD $118.19. Ferrous market spiked as the over-expected 1-trillion yuan debt issuance to support economy and resolve debt structure. Iron ore saw resilient demand on discounted sources. However the low margin resisted demand on mid-grade and high grade iron ores. There was fixed trade of MACF at $117.35 yesterday. Market started to buy lumps as northern China will enter winter in next 4-5 weeks, when more production curbs are expected.

• BHP narrowed iron ore term discounts for November JMBF from 2.5% to 1%.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 24th)

• Futures 134,805,800 tons(Decrease 1,172,400 tons)

• Options 120,227,600 tons(Increase 1,017,500 tons)

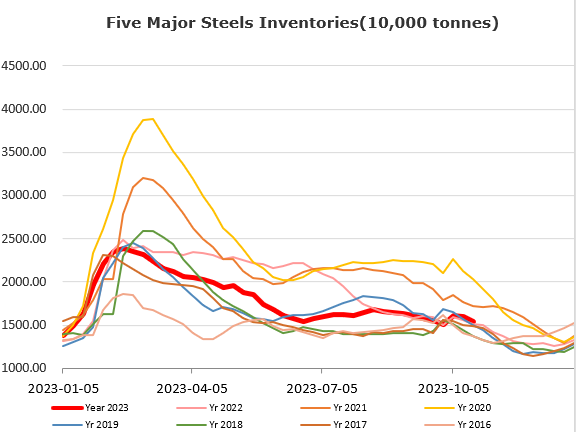

Steel Key Indicators:

• According to World Steel Association, global crude steel production at 149.3 million tons in September, down 1.5% on the year. China produced 82.1 million tons of crude steel, down 5.6% on the year.

Coal Indicators:

• The ex-India buying activity supported the FOB Australia market. The limited PMV supplies and recovered China sentiment by the financial stimulus potentially become supportive factors for the next trade.