Market Verdict on Iron Ore:

· Neutral.

Macro

· China PM Li Keqiang and state council held a conference request to accelerate issuance of specialized debts in the coming year.

· U.S. FOMC notes revealed a flexible date on the interest rate raise.

· Indonesia president indicated the country potential stop exporting in the year 2024, stop exporting bauxite in the year 2022, and stop exporting copper in the year 2023.

Iron Ore Key Indicators:

· Platts62 $103.45, +4.00, MTD $93.97. China northern ports only accounted for less than 50% of the growth over the previous three trading days compared to DCE iron ore futures. In addition, seaborne trades were light during the week, since physical traders believed the SGX iron ore went up too fast, and expecting a small retreat in short-run.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 24th)

· Futures 84,893,600 tonnes(Increase 1,509,600 tonnes)

· Options 72,012,500 tonnes(Increase 220,000 tonnes)

Steel Key Indicators

· Tangshan average steel mills billet cost 4048 yuan/tonne, down 247 yuan/tonne w-o-w. Steel profit margin 272 yuan/tonne, up 387 yuan/tonne w-o-w.

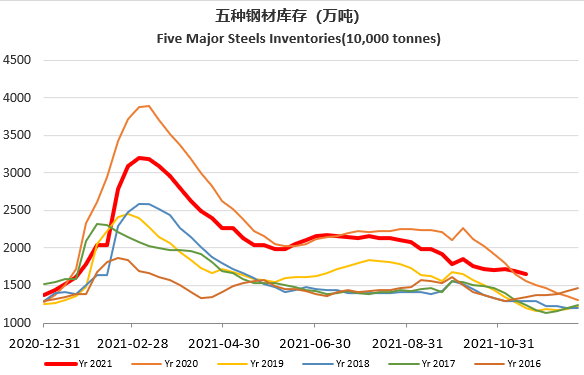

· MySteel Rebar: production 2.72 million tonnes, up 0.62% w-o-w. Mills inventory 2.65 million tonnes, down 5.39% w-o-w. Circulation inventory 4.43 million tonnes, down 6.52% w-o-w.

Coal Indicators

· China NDRC indicated the coal at power plants reached 147 million tonnes, expecting the inventory level will be higher than last year by the end of November.