Market Verdict on Iron Ore:

• Bearish.

Macro

• EU issued a guidance document saying that it is feasible to pay on Russian natural gas with rubles, without violating the sanctions.

• US Treasury Secretary Yellen hinted that in order to get rid of the highest inflation in 40 years, the United States is open to reducing the tariffs on Chinese imports generally imposed during the Trump-Era.

Iron Ore Key Indicators:

• Platts62 $150.5, +0.45, MTD $154.4. One laycan of PBF was traded at fixed price last week, which was rarely seen over the last two months. The previous fixed price laycan was traded in early April. However seaborne trades were sluggish in general and very few interests are heard from buyers. Tangshan area reported that at least12-13% of steel capacity were stopped due to the pandemic. The city announced recovery industrial activities today, however the untimely temporary closure expected to become a normal status in the coming few weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 22nd)

• Futures 83,567,900 tonnes(Increase 1,297,600 tonnes)

• Options 84,639,000 tonnes(Increase 694,500 tonnes)

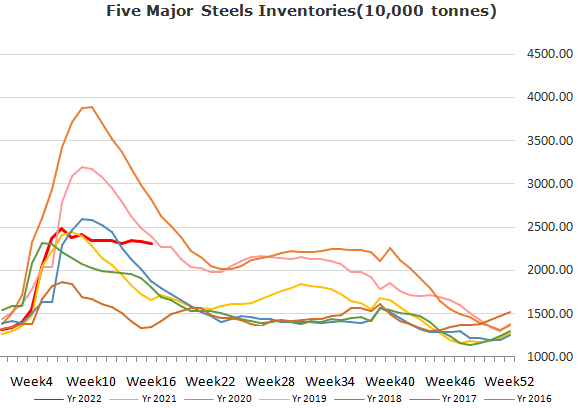

Steel Key Indicators

• MySteel researched 40 EAFs avreage cost 5072 yuan/ton, up 37 yuan/ton. Average profit 29 yuan/ton, down 6 yuan/ton.

Coal Indicators

• The Platts report indicated that there were at least three different mills sellers participating in the mills’ buy tender, Tata Steel concluded one long-waiting tender at $449/mt FOB Australia, down $60 because there were many unsold cargoes.

• The second biggest coal port Ceke in Mongolia opened in April 25th. The port has closed for six months previously due to the pandemic spread. All Mongolia coal export ports expected to recover to high clearing level to increase supply to China significantly.