Verdict:

• Short-run Neutral to Bearish.

Macro:

• NAR statistic indicated that the sales of existing homes increased by 3.1% in January, which created the highest level since August 2023. S&P Global statistic indicated that the US February PMI dropped from 52.0 to 51.4.

• IMF indicated that Japan economy could soften in 2024, while UK potentially see an earliest recovery in late 2024 according to its high frequency indicators.

Iron Ore Key Indicators:

• Platts62 $121.10, +0.50, MTD $126.81. The coming Two Sessions in March in China raised concerns on further production restrictions, which resulting in a rapid narrowing of the price difference for port price of concentrates in Tangshan and Shandong. At present, the only demand in the market is almost all for low-grade or medium grade Brazilian resources due to deepening of loss among Chinese steel mills. SSF has seen a transaction with a 5.85% discount, but the market immediately expected the discount to drop to 6% in the next few weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 23rd)

• Futures 116,685,300 tons(Decrease 1,360,900 tons)

• Options 118,092,800 tons(Increase 1,537,500 tons)

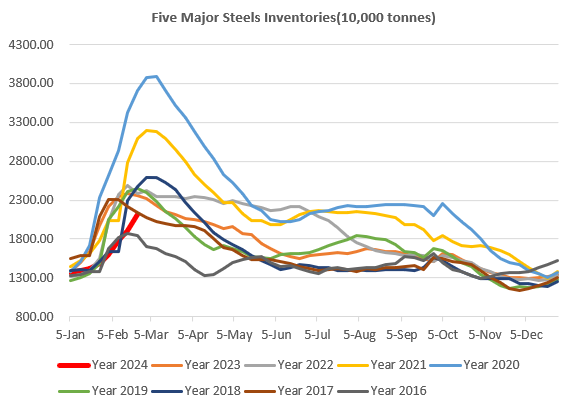

Steel Key Indicators:

• MySteel researched China iron ore inventories at 95.31 million tons, down 375,100 tons on the week, up 3.93 million tons on the year.

Coal Indicators:

• The several unsold near month laycans added to the pressure on the FOB Australia coking coal market.

• MySteel researched 16 China ports coking coal inventories at 5.46 million tons, up 32,300 tons on the week.