Verdict:

• Short-run Neutral.

Macro:

• The World Steel Association statistic indicated that total crude steel production at 148.8 million tons, up 3.7% on the year.

Iron Ore Key Indicators:

• Platts62 $108.80, -0.30, MTD $110.73. The MACF was traded at fixed price at $107.3 yesterday. All rest of concentrates were facing oversupply except MACF. The procurement was slower than expected. Some south-western China mills extend maintenance to avoid marginal loss. Construction activities were recovering in slow pace.

• China 45 port arrivals at 23.497 million tons, up 726,000 tonnes on the week. Six northern ports arrivals at 12.635 million tons, up 1.91 million tonnes on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 25th)

• Futures 120,374,900 tons(Decrease 318,500tons)

• Options 140,954,600 tons(Increase 1,262,500 tons)

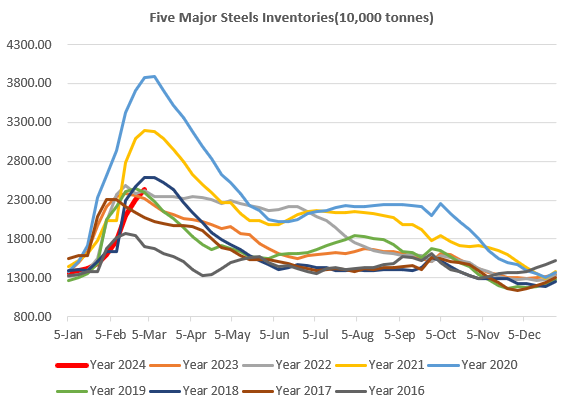

Steel Key Indicators:

• SS400 HRC FOB Tianjin down $15 to $540/mt this week.

Coal Indicators:

• Australia FOB coking coal market was quiet yesterday. The PMV offer at $245/mt was unchanged from previous day.