Market Verdict on Iron Ore:

• Neutral.

Macro

• The general office of the State Council issued the opinions on expanding effective investment, including big infrastructure projects. Promote the healthy development of real estate investment trusts (REITs) .

• China PM Li Keqiang: gurantee the Q2 economy growth and decrease unemployment rate.

• FedWatch indicated that the probability of 50 basis interest rate hike in June and July respectively reached 90%. The probability of accumulated 100 interest rate hike in July reached 93.7%.

Iron Ore Key Indicators:

• Platts62 $133.40, +2.9, MTD $133.19. Seaborne PBF obtained growing interests, in particular after price correction. However buyers are still preferring MACF. China MACF at port areas decreased fast. South Flank mines expected to ship more MACF to China. 65-62 spread remained narrow around $23 because of the thin steel margin. Some traders indicated that mills resold Carajas fine considering the cost. SSF discount narrowed for consecutive months while SSF/PBF ratio also narrowed, indicating the low grade fines are favorable options for end-users to optimise cost-efficiency.

SGX Iron Ore 62% Futures& Options Open Interest (May 25th)

• Futures 81,657,600 tons(Increase 559,300 tons)

• Options 77,013,500 tons(Increase 156,000 tons)

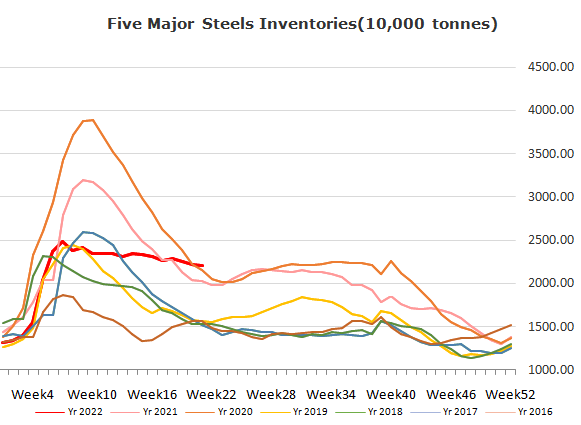

Steel Key Indicators

• Tangshan steel billet cost 4572 yuan/ton, down 92 yuan/ton w-o-w. Average profit – 102 yuan/ton, up 2 yuan/ton.

Coal Indicators

• More tractable coking coal sales from U.S. flow into Atlantic and Asian market, drag down the performance of PMV Australia market, however increased the price width among brands.