Verdict:

• Short-run Neutral.

Macro:

• US Federal governor Miki Bowman said the earliest interest cut would be in 2025 concerning the high inflation rate. However, the other governor Lisa Cook indicated the inflation went down in March and June, the interest cut in 2024 would be propriate.

Iron Ore Key Indicators:

• Platts62 $103.75, +1.10, MTD $106.53. Steel demand in June maintained sluggish as heavy rain disrupted some normal operation of constructions in China. Steel mills were forced to adopt conservative strategies by blending concentrates in to cost-efficient way. However, there was BRBF traded at $104.6, which supported index yesterday. The high trade was because of tight supply from Brazil.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 25th)

• Futures 129,734,000 tons(Increase 99,000 tons)

• Options 176,198,700 tons(Increase 1,351,600 tons)

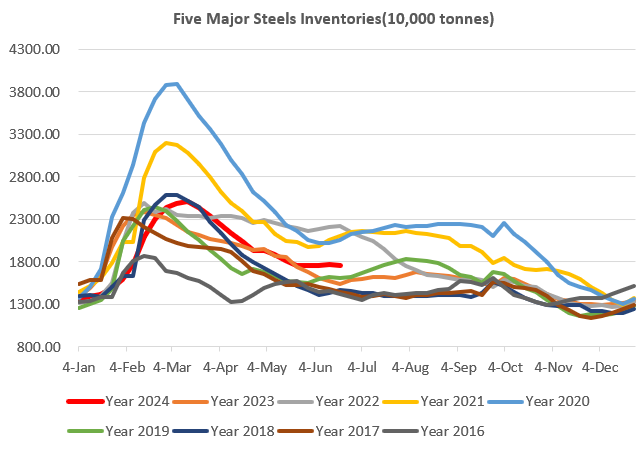

Steel Key Indicators:

• FOB Tianjin HRC was $525, $3 lower from beginning of the week, $8 lower from past week. The drop was due to Indian buyers lowered bids by $10-15. China HRC became slight expensive than Vietnam HRC after added tariffs.

Coal Indicators:

• The FOB Australia coking coal maintained unchanged for index in this week after a big correction following a low trade previously. The offers potentially became lower if it takes longer time for firm bids on market.