Market Verdict on Iron Ore:

• Neutral.

Macro:

• IMF increased the global GDP increase from 2.8% in April to 3%.

Iron Ore Key Indicators:

• Platts62 $116.75, +2.25, MTD $112.51.The fast narrowed discount in MACF potentially mean JMBF became cheaper with a stable wide discount. There was JMBF traded at $4 discount based on August Index. There was a September PBF traded at $117.15, however fell out of Platts assessment window. SSF was traded at ports in H1 in most of circumstances.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 25th)

• Futures 110,149,700 tons(Increase 2,409,100 tons)

• Options 107,059,300 tons(Increase 1,901,000 tons)

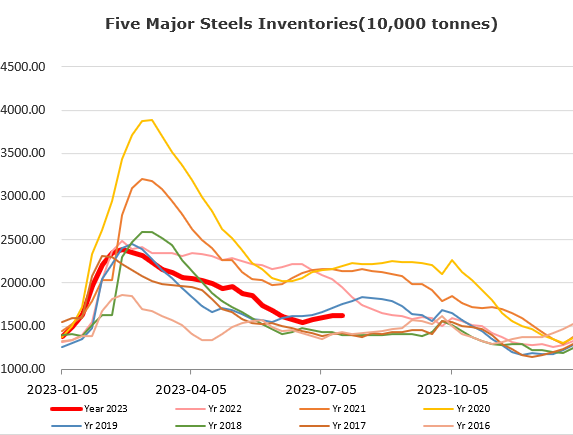

Steel Key Indicators:

• According to World Steel Association, global crude steel production in June at 158.8 million tons, down 0.1% on the year. China crude steel in June produced 91.1 million tons, up 0.4% on the year. India crude steel in June produced 11.2 million tons, up 12.9% on the year.

Coal Indicators:

• The seaborne FOB coking coal was stable during this week. PLV tradeable value maintained around $237.