Verdict:

• Short-run Neutral to Bullish.

Macro:

• US Federal chairman Jerome Powell released the strongest ease signal on interest cut during the Jackson Hole’s bankers week, which exceeded market expectation previously.

• China Ministry Department of Industrial and Information department announced capacity change, which will prevent illegal market capacity increase. Market read as a alternative cut on steel capacities overall.

Iron Ore Key Indicators:

• Platts62 $96.00, -1.00, MTD $98.10. As the China new capacity restriction on steel making published, steel price saw recovery. In addition, the restocking before September started. However, market participants were also concerning that the overall reduction on capacities potentially resist the iron ore price through H2.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 23rd)

• Futures 139,589,200 tons(Increase 2,484,100 tons)

• Options 163,450,100 tons(Increase 1,805,500 tons)

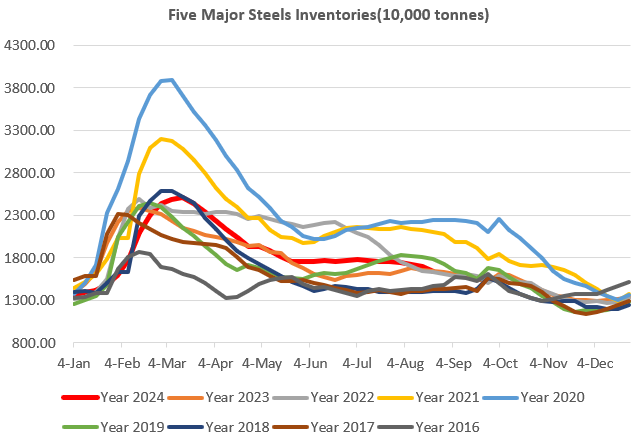

Steel Key Indicators:

• China Lecong HRC capacities reached 1.0658 million tons, down 3.62% on the week, which was the first drop after a five-year high inventory 1.10 million tons last week. Lecong is the most important area in China to observe HRC inventory.