Market Verdict on Iron Ore:

Neutral to bullish.

Macro

To stabilize foreign exchange market expectations and strengthen macro prudential management, the People’s Bank of China has decided to raise the foreign exchange risk reserve ratio of forward exchange surrendering from 0-20%.

U.S. Nasdaq corrected 5.03% during last week, total down 16.7% from August 12th, indicated a panic in investment market upon the interest hike and the recession concerns.

Chinese Automobile Association statistic indicated August auto export at 308,000 units, refreshed historical single month high. Jan- Aug total exoprted 1.817 million units, up 52.8% on the year.

Iron Ore Key Indicators:

Platts62 $99.60, +0.85, MTD $98.93. PBF and NMHG regained popularity, with significantly improved volume in late half of August and discount/premium, however market participants believed that the current level was close to roof area as there were not enough room on the steel margin left. Thus, low grade and discount iron ores including JMBF regained market interest with narrowing discounts. ITG sold 150,000mt PBF to Majestic Rock Resources Group during MOC at October Index + $0.45. CSN sold multiple laycans of IOC6 at October Index with a discount of $4.6- 4.75 this week, currently market saw improving interest in high silica products.

Benedikt Sobotka, CEO of diversified miner Eurasian Resources Group (ERG), said that iron ore pellet spot premiums of $25-$45/mt over the 62% grade could be considered “reasonable” aligned to the fact that high energy costs and low emitting materials in the next decade.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 23rd)

Futures 107,178,500 tons(Increase 576,100 tons)

Options 92,948,100 tons(Increase 809,000 tons)

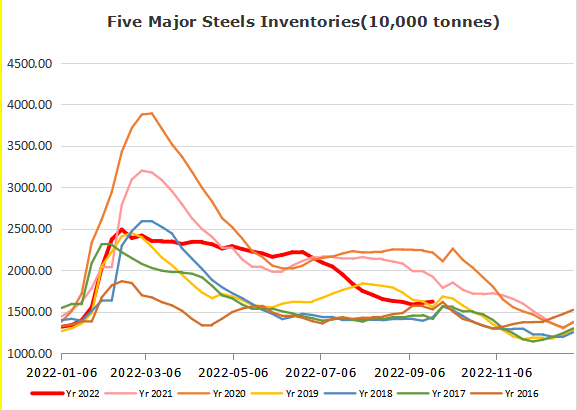

Steel Key Indicators

Jefferies International indicated that the production closure in Europe would potentially lead to a loss of 10% capacity.

MySteel estimated 40 EAFs average rebar cost 4190 yuan/ton, down 54 yuan/ton. Average loss 179 yuan/ton.

Coal Indicators

Australia FOB coking coal remained quiet around $258, the market was waiting for a clear direction before Australia entered wet season as well as the uncertainty caused by industrial action.

MySteel estimated 30 cokery plants with average coke production loss at 800 yuan/ton.