Verdict:

• Short-run Neutral to Bearish.

Macro:

• ECB banker Christian Lagarde indicated that the 2% inflation target must be realised. ECB governor indicated the first interest cut would start in June.

• Reuters: India is considering an export tax on low-grade iron ore after small steel producers urged the government to curb its overseas sales.

Iron Ore Key Indicators:

• Platts62 $116.00, -5.10, MTD $126.17. The low steel margin after Chinese New Year slowed down the recovery of production by steel mills. The coming Two Sessions in March in China raised concerns on further production restrictions, which resulting in a rapid narrowing of the price difference for port price of concentrates in Tangshan and Shandong. At present, the only demand in the market is almost all for low-grade or medium grade Brazilian resources due to deepening of loss among Chinese steel mills. BHP sold 90,000mt NHGF at $115.3, which was lower than other mid-grade brand because of the low cost-efficiency on NHGF.

• China six northern ports at 10.68 million tons, down 3.12 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 26th)

• Futures 117,044,100 tons(Increase 358,800 tons)

• Options 122,752,800 tons(Increase 4,660,000 tons)

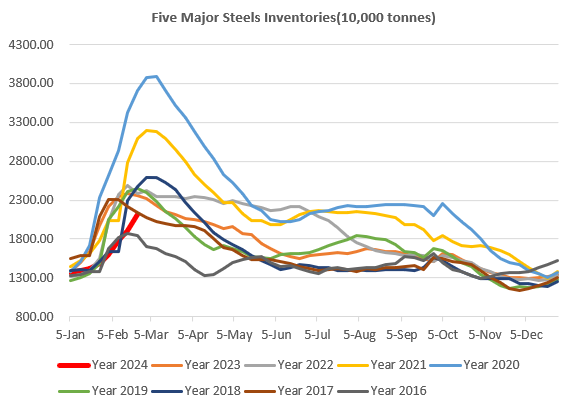

Steel Key Indicators:

• Vietnam Steel Association expected that the steel consumption up by 6.4% in 2024, export reached 13 million tons, which was 2.6 times bigger compared with 2022.

Coal Indicators:

• The several unsold near month laycans added to the pressure on the FOB Australia coking coal market.

• China Hebei, Tianjin started the fourth round of price cut on physical coke by 100 yuan/ton, total down 400-440 yuan/ton for the last four rounds.